The key insight of Modern Portfolio Theory (MPT): Don’t weigh an asset’s risk independently, but by how it contributes to the portfolio’s overall risk. MPT, the brainchild of economists Harry Markowitz and others, dates from a 1952 Markowitz essay describing a system for assembling a portfolio of assets maximized for a given level of risk.

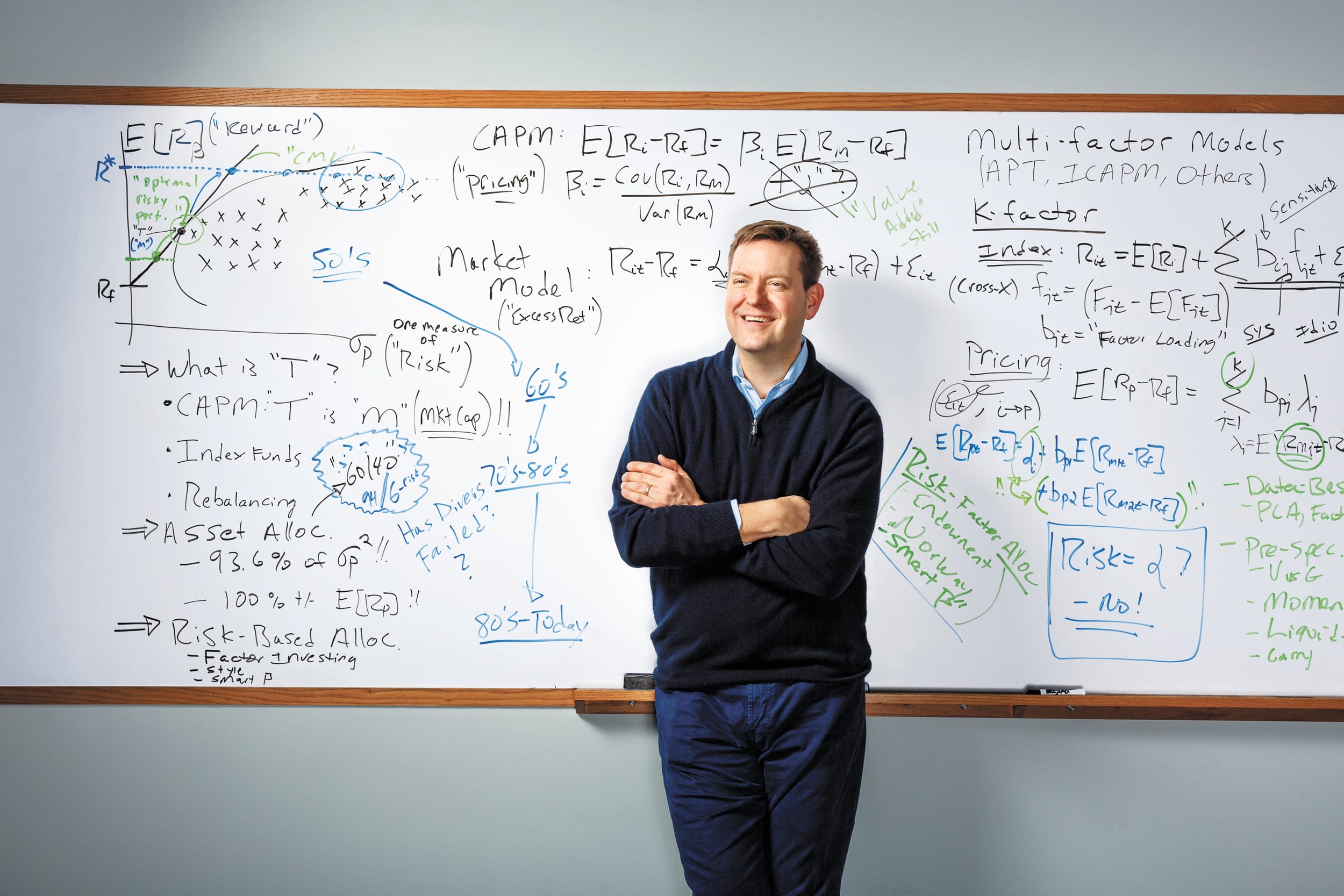

When Wharton Magazine invited finance professor Chris Geczy to deliver a “class” for us, he presented on MPT and risk factor investing. Most investors in the seventies and eighties thought of their portfolios in the context of the Capital Asset Pricing Model (CAPM). Described by Sharpe in 1970, CAPM theoretically helps investors by relating expected return to systematic risk.

Many investors think of a well-diversified portfolio in terms of a 60/40 allocation that eventually reallocates toward less-risky investments. Geczy, who directs the Jacobs Levy Equity Management Center for Quantitative Financial Research, thinks the model’s usefulness may have ebbed. Until recently, a well-managed 60/40 portfolio saw a return of around 8%. “Since 1961, traditional models forecasted 9.1% (9.2% in the U.S. at the index level); but today most are expecting 4% to 5%.”

What are the options? Seek more risk, and diversify across it. Pursue higher returns by leveraging up such a better-diversified portfolio, or by concentrating on higher-risk assets like small caps, real estate or venture capital. However, Geczy doesn’t recommend sacrificing diversification for concentration in equities or assets that may be exposed to the same risks or losses at the same time.

Today’s MPT broadens your choices. Thanks in part to expansions in the theory and investing practices, now instead of focusing only on allocating a portfolio’s assets, we can directly characterize and allocate risk across the portfolio.

That’s why, according to Geczy, diversification isn’t dead. It’s shifting from asset-based allocation to risk-based. —Louis Greenstein

Published as “At the Whiteboard with Chris Geczy” in the Spring/Summer 2016 issue of Wharton Magazine.