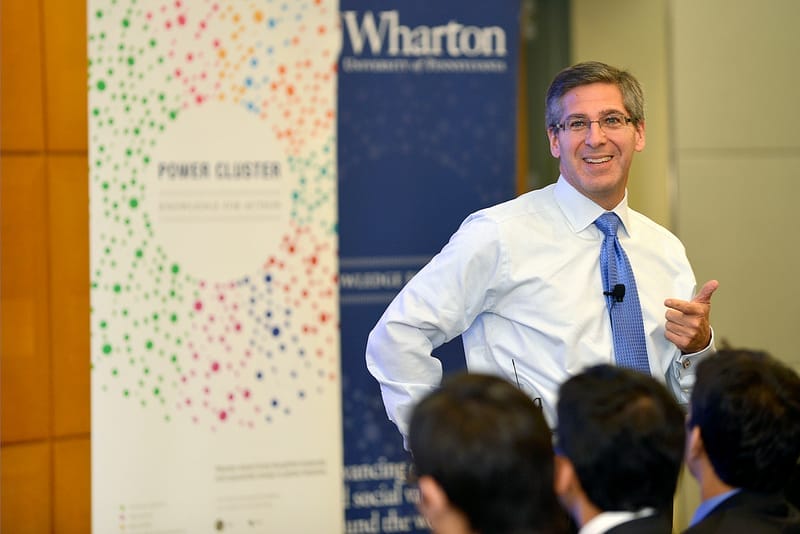

PricewaterhouseCoopers is poised to swallow Booz in a play that will boost the former’s top-end market share in the strategic consulting space. So when Bob Moritz, PwC’s U.S. chairman and senior partner, stood before a room of Wharton students on Nov. 19, the question was bound to emerge. And eventually, indeed, one Wharton MBA student raised his hand and asked:

How will the merger affect PwC/Booz recruiting on campus?

Moritz did not directly respond, but to his credit he made the case for why today’s Wharton graduates would want to work for PwC, whether as a high-end consultant, accountant or auditor. The gist of it is: PwC has studied the millennial generation and attempted to craft workplaces and employment policies to attract and retain them, such as flexible schedules, supporting gadgetry and tech company-like campuses.

What was perhaps most compelling about Moritz’s campus talk—part of the Michael L. Tarnopol Dean’s Lecture Series—beyond his identification of the usual business “megatrends” (technology, big data, demographics, resource scarcity), was his frank dissection of his own life, particularly these snapshots:

1987: Two years into his career at PwC, Moritz was a self-confessed underperformer. He turned it around, he told the audience, by devoting himself to the job and by discovering his place in the bigger company picture. For him, that was developing sought-after expertise in securitization.

1991: He worked for PwC Tokyo in the early ’90s in Japan. In one instance, he was auditing a local bank and interviewing one of its officers, who responded by reaming him out with Japanese swears. Auditors in Japan, it turned out, were valued lower than trash collectors, said Moritz, simply because it was not customary to question authority—an important lesson in cultural diversity for the future chairman.

2001: After Sept. 11, 2001, Moritz and a close team devoted hours and days to tracking down all of the 250 PwC employees who worked in the Twin Towers. They weighed the need to call moms and dads and ask: Is your son or daughter still alive? (All survived, though PwC lost associates on the planes.)

2002: When Arthur Andersen fell apart in Enron’s wake, Moritz met with many of the casualties. He remembered the tears in many of their eyes, and how he was more aware of the inner goings-on at Andersen than were its own employees. The lessons: his personal responsibility to employees and the need for a transparent company culture.

1985 to ??: Moritz confided that he has considered leaving PwC five times over his tenure: first when he realized after two years in that he wasn’t doing well, another when a client tried to poach him, once in Japan, and twice when JP Morgan Chase courted him. In the last instance, he said, JP Morgan Chase aimed to hire him as controller on a CFO track, but Moritz remained because he valued the diversity of his PwC work (he still serves clients and develops business while also focusing on back-end operations) and the company culture.

Moritz, by the way, was confident that the Booz-PwC deal will close by February 2014.

Editor’s note: View more photos from Moritz’s Michael L. Tarnopol Dean’s Lecture at Wharton’s Flickr stream.