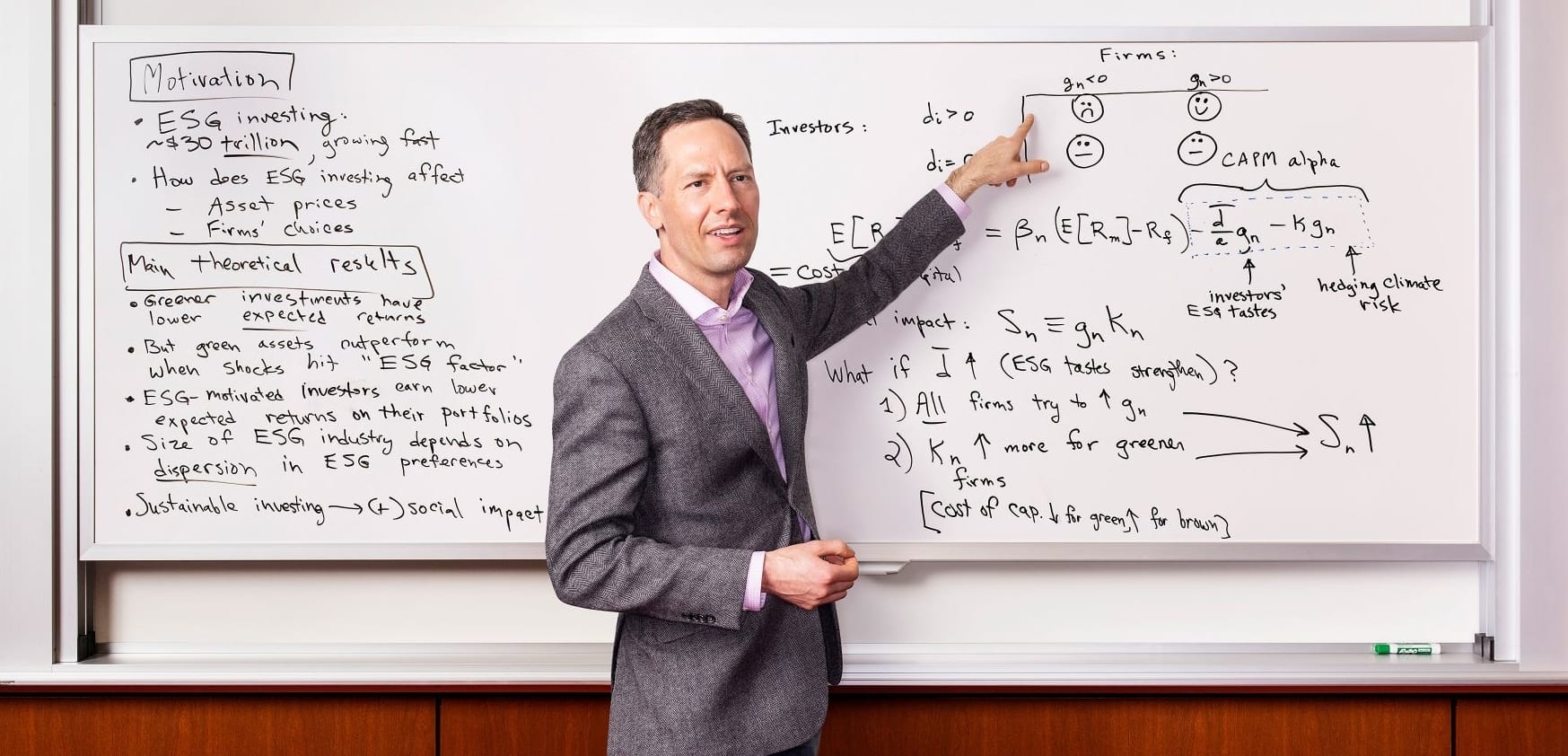

Shareholders of stocks that meet environmental, social, and governance (ESG) criteria may feel good about these investments. But does green investing have a positive impact on society? And how does green investing affect stock prices? Those are the questions associate finance professor Luke Taylor and his co-authors ask in their paper “Sustainable Investing in Equilibrium,” which aims to provide theoretical guidance on the approximately $30 trillion ESG market.

Taylor — along with Wharton finance and economics professor Robert Stambaugh and Chicago Booth finance professor Lubos Pastor — presents four main findings: First, that green assets have lower expected future returns than “brown assets” such as coal stocks. Second, that even though green stocks are expected to underperform, they can end up outperforming brown stocks. “That happens when shocks hit,” says Taylor. For example, unexpected climate-related events can send investors scurrying away from less environmentally friendly stocks. Such shocks may explain why green stocks have outperformed over the past decade. “Going forward, though, our model predicts that green stocks will underperform,” explains Taylor. “But over any period of time, if the shocks are strong enough, green outperforms brown.”

The researchers also found that individual investors’ ESG portfolios are expected to perform worse than brown portfolios. ESG investors aren’t behaving irrationally, however. “While you expect green stocks to underperform,” Taylor explains, “you still feel good about holding them.”

Lastly, in theory, green investing does lead to positive social impact. When investors care more about ESG, two things happen. First, firms choose to make their operations greener because they know doing so will increase their market values. For example, a coal plant may install scrubbers to reduce pollution. In addition, green firms’ cost of capital decreases relative to that of brown firms. As a result, capital investments shift from brown to green firms, and coal plants could shut down while solar farms expand.

“I used to think that ESG investing would have no effect on what companies do — that if some institutions divest from coal stocks, it won’t do anything, because other investors offset that,” says Taylor. “Now, I understand that’s wrong. Our findings are good news for ESG investors, for the environment, and for society.” The researchers’ next step is to gather data and test their model’s predictions. “This is just a start,” Taylor says. “There’s so much more we need to understand about the rise of sustainable investing.”

Published as “At the Whiteboard With Luke Taylor” in the Spring/Summer 2021 issue of Wharton Magazine.