In 1991, Andrew D. Seidel, WG’90, took a position with an obscure water-treatment company in Southern California. Not long before his arrival, the company had been known as American Toxxic Control Inc., a name as unappealing as its spelling was peculiar. Plus, it had been in bankruptcy.

However, Seidel and other members of the company’s new executive team saw tremendous opportunities for growth and consolidation in the water business and set out to improve the firm’s fortunes. “The name was the first thing to go,” Seidel recalls. “The [old] management team was the second.”

However, Seidel and other members of the company’s new executive team saw tremendous opportunities for growth and consolidation in the water business and set out to improve the firm’s fortunes. “The name was the first thing to go,” Seidel recalls. “The [old] management team was the second.”

Equipped with a new moniker — U.S. Filter Corp. — and new leadership, the company embarked on an ambitious acquisition campaign. Many of the acquired firms were what Seidel calls “corporate orphans,” subsidiaries put up for sale by their parent companies due to lackluster profits. Because it was growing so rapidly, U.S. Filter also had to move fast to hire people to manage its new holdings. Hence, an acquisition program of another sort followed.

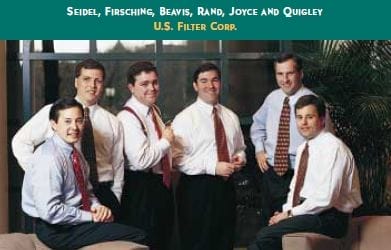

Seidel started recruiting fellow alumni. Over the next five years, six Wharton graduates — most of whom had worked at the Philadelphia office of Deloitte & Touche — joined U.S. Filter. They were Frank Firsching and Benjamin Rand, both of them classmates of Seidel’s, along with Robert Joyce, WG’91, Jeffrey Quigley, WG’89, Bruce Beavis, WG’88, and Anthony Horvat, WEMBA’89.

“We were looking for talent,” says Seidel. “The easiest thing to do is call people you know.”

Many of the 750 students who graduate from the MBA program each year, as well as approximately 100 WEMBA graduates, fan out in different directions after the diplomas are conferred and never cross paths again. But others — some right away, some years later — decide to build on their school-days’ relationships by starting companies from scratch or, like Seidel and his colleagues, by joining forces to help an existing small firm grow. Call it the buddy system, or networking or just plain common sense, but alumni who’ve done it — educators, a restaurateur, hedge-fund managers and others — say it’s an arrangement that can be professionally beneficial and personally rewarding.

“The reason we went back to Wharton and Deloitte & Touche was trust,” says Seidel, whose company has made about 130 acquisitions in the past seven years. “When you’re growing this fast, you can’t worry about politics and all this corporate stuff that goes on in companies. We all knew each other and I knew they’d give 110 percent if they had to.”

Today, Seidel and his fellow alumni comprise the core management team of the Palm Desert, Calif.-based firm, the world’s fastest growing water and wastewater treatment company. As of February, U.S. Filter had an annual revenue run rate of more than $4.5 billion, and in 1997 was featured for the third year in a row as one of Fortune magazine’s 100 fastest growing companies. When Seidel joined the company, it had just $17 million in revenue.

“What we’ve been able to do is run this decentralized business organization without everybody killing each other,” says Seidel, who today serves as president and chief operating officer of U.S. Filter’s Wastewater Management Group. “Everybody has been heavily incented by stock options. And there’s trust. No one person is going to do anything to damage the performance, reputation or future of the other person. You need that to get through a high growth company where there are very few rules and the rules change as you go.”

![]()

On Fridays during their second year in the MBA program, Bradley H. Cary, WG’89, and A. Pendleton DuPuis, WG’89, often played golf. It was a time when they could talk about business and the future. Cary and DuPuis had known each other for years — both attended Hampden-Sydney College in Virginia — but they didn’t become really close until their time at Wharton.

DuPuis majored in entrepreneurial management, Cary in marketing. During their strolls along fairways and greens, DuPuis continually tried to talk Cary into doing something entrepreneurial. “Eventually, I broke down and we decided we’d start something or buy something,” Cary says. “Through a series of odd coincidences we came upon this business that was run by a husband and wife who had started it 12 years earlier. It was the right size and we could afford it considering neither of us had any money.”

Just one month after graduation, Cary and DuPuis bought the assets of the Center for International Business and Travel, now formally known as CIBT Inc., and became president and executive vice president, respectively. Previously, the firm specialized in obtaining passports and visas for the leisure-travel market. But DuPuis and Cary decided on a new focus that they felt offered much greater growth potential — providing visa and passport processing services for corporations.

Just one month after graduation, Cary and DuPuis bought the assets of the Center for International Business and Travel, now formally known as CIBT Inc., and became president and executive vice president, respectively. Previously, the firm specialized in obtaining passports and visas for the leisure-travel market. But DuPuis and Cary decided on a new focus that they felt offered much greater growth potential — providing visa and passport processing services for corporations.

CIBT, which has since branched out into related corporate services, now serves more than half the companies in the Fortune 100 and has been ranked in the Inc. 500 the last three years. In addition to its headquarters in McLean, Va., CIBT has offices in Atlanta, Boston, Chicago, Houston, Los Angeles, Miami, New York, San Francisco and Washington. It has grown from six employees and annual sales of $400,000 to 105 employees and sales of just over $12 million.

“At the time we came into the industry, I believe the largest firm had about 20 employees,” Cary says. “There’s been a consolidation, and we’re two to three times larger than the next largest company.”

Cary and DuPuis bring different talents and temperaments to the business. DuPuis, who used to build flight simulators for an aerospace company, handles sales, account management and the financial and accounting department; Cary, who formerly worked in product management for a regional bank in Richmond, oversees management information systems and all operations. They make joint decisions on major issues, but each takes care of his own areas day to day.

Cary uses a golf analogy to illustrate his point: DuPuis usually slices the ball, while Cary is prone to hooking it. Each player eventually arrives at his ultimate destination, the middle of the fairway, but from a different direction.

Despite their differences, Cary says he and DuPuis are able to make decisions quickly, which they believe is essential for entrepreneurs. “The key for us is we have complementary skills. Without that, it might have proven difficult to work together.”

CIBT was slow in getting off the ground. “We thought we could come in and immediately grow,” Cary says, “but the reality was we had to learn the business and learn the market and establish the right strategy. Since then, we have completely outpaced even our most optimistic expectations for the growth of the company.”

![]()

Sometimes the decision to start a business with fellow alumni takes place after graduation. Consider Integrity Capital Management, L.L.C., a start-up hedge fund in New York. Four of the firm’s principals are Wharton graduates: Bruce S. Darringer, W’91, chief operating officer and general counsel; Ross L. Stevens, W’91, managing principal and chief executive officer; Andrew K. Tsai, W’93, chief investment officer, and Stephen R. Warren, W’93, chief financial officer.

The fund, which holds more than 450 positions, is highly diversified, with investments in stocks, bonds, currencies and commodities in more than 20 countries. Its objective is to produce consistently high risk-adjusted returns that exhibit low correlation with major market indices and traditional portfolios.

“Our edge is in exploiting an extremely large number of small inefficiencies in contrast to a more common approach of exploiting a small number of large inefficiencies,” says Darringer, an attorney and derivatives specialist.

“Our edge is in exploiting an extremely large number of small inefficiencies in contrast to a more common approach of exploiting a small number of large inefficiencies,” says Darringer, an attorney and derivatives specialist.

From its establishment on July 1, 1997, through Jan. 31, 1998, the fund posted a net return of 28.1 percent, compared with 11.3 percent for the Standard & Poor’s 500 index. During that period, the fund had a negative 0.24 correlation with the S&P 500. As of Feb. 1, 1998, total assets under management exceeded $160 million, according to the firm.

It was Stevens, armed with a PhD in finance from the University of Chicago, who developed the idea for the fund. At the time, he was working at Goldman Sachs Asset Management. He enjoyed his responsibilities there, but after kicking around the idea with Darringer, his best friend, Stevens decided in early 1997 that the kind of innovative fund he wanted to launch was best done in a “boutique environment.”

Stevens then talked to Warren, a colleague at Goldman Sachs. Warren, in turn, suggested Stevens talk to Tsai, who was at Lehman Brothers. A fifth non-Wharton partner, Frederick W. Tausch, was brought on board to be director of technology. Stevens says it wasn’t easy for the principals to decide to start the firm because each already “had a clear-cut career path. This was an uncomfortable decision to make.”

Darringer describes Stevens as “the center of the wheel trying to pull in the team. . . We realized it would be great to take a chance at this point in our lives and try and make history by building something from scratch.”

![]()

Another company launched by Wharton alumni in 1997 was PriceScan of Bryn Mawr, Pa. The privately held firm was founded by David Cost, W’85, a former consultant in management information systems, and Jeffrey J. Trester, who received a PhD from Wharton in 1993.

Cost is president and CEO. Trester is director and an “angel investor” (an early-stage venture capitalist) in Price-Scan. He also is founder of Jeffrey J. Trester & Company, an investment advisory firm whose practice includes venture consulting, and a senior research fellow at Wharton’s Financial Institutions Center.

PriceScan is a free, Internet-based service that offers comparative price and product information on computer hardware, software and supplies. In short, it helps shoppers find the items they want at the best price. Instead of spending hours poring over magazine and newspaper ads, people can tap into PriceScan and get the information they need in a matter of minutes.

For instance, a consumer may be interested in a personal computer but doesn’t know what make and model he or she wants. But let’s say the consumer does know that the PC has to have certain features, like a Pentium II processor, 32MB of RAM and a built-in modem. By entering these features into PriceScan, the prospective buyer will get a list of products, sorted by price, that satisfies these specifications. PriceScan also provides a list of vendors selling the product.

For instance, a consumer may be interested in a personal computer but doesn’t know what make and model he or she wants. But let’s say the consumer does know that the PC has to have certain features, like a Pentium II processor, 32MB of RAM and a built-in modem. By entering these features into PriceScan, the prospective buyer will get a list of products, sorted by price, that satisfies these specifications. PriceScan also provides a list of vendors selling the product.

“The site gets refreshed every day,” says Cost. “We use data from vendors’ ads, their Web sites and catalogues.”

Cost and Trester’s dream was to do for consumers what organizations like Bloomberg did for individual investors — level the playing field by making price information more transparent. The pair seem to be succeeding. In less than a year of operation, they say PriceScan has millions of users, and not all of them small buyers.

“We have a large number of business users,” says Trester. “Parts of Fortune 500 companies don’t buy computers without checking PriceScan.”

Trester and Cost were introduced through a mutual friend at Penn in 1993, but they didn’t consider going into business together until a few years later.

“We found we had a lot of similar takes on where the information superhighway was going and very similar opinions on who was doing it right,” says Trester. “At one point David, who was a computer consultant at the time, was helping me select a printer. He noted that there were enormous price discrepancies in the consumer market and that it would be practical to do Web-based price comparisons.”

Their common Wharton background has been pivotal. “Coming from the same school with that common outlook about business, economics, management and finance — and having a common [business] language — has been very beneficial,” Trester says. “We can communicate without misunderstanding.”

Going forward, the company wants to expand to include sporting goods and other products to attract more price-savvy shoppers. Says Trester: “You should see the fan mail we get. For some of these people, it’s a religious experience.”

![]()

Sometimes there can be a big gap between the emergence of an idea and its implementation, with plenty of detours along the way. Just ask Ellen Yin, W’87, WG’93.

To earn money to go to college, she was a bus girl at a French restaurant in her hometown in New Jersey. While an undergraduate, she waited on tables and tended bar at La Terrasse and the White Dog Café on Penn’s campus. It was then that Yin decided she wanted to own a restaurant.

To earn money to go to college, she was a bus girl at a French restaurant in her hometown in New Jersey. While an undergraduate, she waited on tables and tended bar at La Terrasse and the White Dog Café on Penn’s campus. It was then that Yin decided she wanted to own a restaurant.

“I almost transferred from Penn to Cornell’s hotel school,” she says. “But I decided I was already in Wharton. I compared curricula and just felt that Wharton offered a more well-rounded education.”

Yin majored in entrepreneurial management and drafted several business plans for fictitious restaurants. Even after earning her BA she dreamed of opening her own place. Instead, she joined a small advertising agency that happened to have restaurants as clients. She later worked as a fund-raiser for the American Heart Association before returning to Wharton to get an MBA in health care management.

For the next several years, Yin worked first with Coopers & Lybrand’s Health Care Group and then with Thomas Jefferson University Hospital in Philadelphia. Meanwhile, she was confiding her career frustrations to a good friend, Roberto Sella, WG’93.

A couple of years ago, Yin decided to take the plunge and open a restaurant. “I put together a business plan, hired a lawyer to help me develop the partnership and started pounding the pavement for financing,” she says.

The result is Fork, an American bistro consisting of 2,500 square feet and 68 seats at 306 Market St. in Philadelphia. Opening day was Oct. 15, 1997. Yin says start-up costs totaled $300,000, two-thirds of which was financed through a loan from the Small Business Administration, while 80 percent of the remaining $100,000 was put up by the business’ three main partners — Yin, Sella and Anne-Marie Lasher. Lasher is Fork’s executive chef and an alumna of the White Dog Café.

Yin says Sella, Fork’s sommelier, has been a valuable partner. “When you know each other’s strengths and weaknesses, things are easier to divide up,” Yin explains. “And I think he is much more supportive than somebody who is just a pure financial backer … We both had a similar understanding about how the restaurant should be set up and run. It’s a bonus for me that he went to Wharton, but the most important thing in a partnership is finding someone you trust.”

![]()

In the 1980s, when officials in the federal government began talking about decommissioning underused military bases and other facilities, Deborah Miller, WG’94, became inspired. Wouldn’t it be terrific, she thought, if those buildings could be converted into top-quality schools for at-risk youngsters?

At the time, Miller was an entrepreneur helping foreign companies start businesses in the United States. She had no background in education. But she met lawyer Carmen Caneda, WG’94, while both were enrolled in WEMBA, and the two women worked together on an independent study project to explore Miller’s idea. After graduation, they formed Children’s Academies for Achievement, a not-for-profit organization in New York City. Miller serves as chair, Caneda as vice chair.

In September 1997, CAA opened its first school, Samuel DeWitt Proctor Academy Charter School in West Trenton, N.J. Proctor Academy, the first public boarding school of its kind to be chartered in the United States, will serve as the model on which future CAA schools will be based. (A charter school operates under the authority of a state-issued charter that permits a private entity to manage a school’s operations outside the regulation of the surrounding school district.)

In September 1997, CAA opened its first school, Samuel DeWitt Proctor Academy Charter School in West Trenton, N.J. Proctor Academy, the first public boarding school of its kind to be chartered in the United States, will serve as the model on which future CAA schools will be based. (A charter school operates under the authority of a state-issued charter that permits a private entity to manage a school’s operations outside the regulation of the surrounding school district.)

Forty-eight seventh- and eight-graders are enrolled at Proctor Academy, which is housed at an underused facility for deaf students on a 108-acre campus. The academy is supported by private and public funds. By law, the students were chosen by lottery from a pool of interested applicants.

CAA hopes that Proctor Academy is educating 140 students in grades 7 through 12 by the year 2001. Indeed, in the future CAA may also open schools at decommissioned military facilities, since Miller hasn’t forgotten her original notion of using bases for sites.

“Boarding is the key component that makes Proctor Academy different,” Miller explains. “We have children from very intact families who feel their kids are too sensitive to withstand the pressures of the streets, drugs and gangs … We see ourselves as an option for the welfare system so that mothers can find jobs. We see ourselves as an option for kids who have been orphaned as a result of the AIDS epidemic. We serve kids who have academic potential but who wouldn’t survive if they didn’t have this setting.”

Miller says she and Caneda would not have had the confidence to start CAA had it not been for the education research they conducted at Wharton, which laid the groundwork for CAA, along with encouragement from the faculty.

The two women have raised $1 million for CAA over the past four years, but it hasn’t been easy because neither had a background in teaching or social work. “The most difficult part,” Miller notes, “was acceptance of each of us in the world of education.”

![]()

As entrepreneurs, Emile J. Geisenheimer, WG’75, his wife, Susan F. Goodrich, WG’76, and B. Martha Cassidy, WG’81, are newcomers. But their resumes reflect many years of success in business.

Among other things, Geisenheimer held senior executive positions with North American Philips Corp. (now Philips Electronics North America) over a period of 12 years. He then joined Nazem & Company as a general partner and developed its health care practice. Goodrich was a communications-industry executive for 15 years, most recently in the music industry as senior vice president at Capitol-EMI Records Group, and has held top positions at Time Warner. Cassidy spent 13 years as an investor in private equity and was a founding partner of APEX Specialty Materials, a producer of synthetic fiber, where she continues to serve as managing director. Before that, Cassidy was an active principal of Rutledge & Co., a buyout fund.

Among other things, Geisenheimer held senior executive positions with North American Philips Corp. (now Philips Electronics North America) over a period of 12 years. He then joined Nazem & Company as a general partner and developed its health care practice. Goodrich was a communications-industry executive for 15 years, most recently in the music industry as senior vice president at Capitol-EMI Records Group, and has held top positions at Time Warner. Cassidy spent 13 years as an investor in private equity and was a founding partner of APEX Specialty Materials, a producer of synthetic fiber, where she continues to serve as managing director. Before that, Cassidy was an active principal of Rutledge & Co., a buyout fund.

Now the three are principals of Madison Investment Partners Inc., a New York City firm that provides private equity financing for management buyouts, recapitalizations and growth. Geisenheimer founded the firm in 1993 while he was still at Nazem. He left Nazem in 1995 to devote all his attention to Madison. Goodrich joined him that same year and Cassidy followed in 1996.

Madison, with its focus on buildups and consolidations, invests in companies that fit a special niche.

“There are tens of thousands of companies that were formed by entrepreneurs after World War II, Korea and Vietnam, and owners of these family businesses are looking for opportunities to exit,” Geisenheimer explains. “But they’re small, and opportunities to exit are limited by that small size. We buy these companies and put them together. We’re not interested in high-tech, Internet or new software companies. We’re interested in the bread and butter of America, the mom-and-pop shop, small manufacturing companies.”

As stand-alones, the opportunities for these companies to grow are limited. But when they are combined, the new organizations can become regional or national players.

Madison Investment Partners gives Goodrich and Geisenheimer a chance to work together again -– they had done so for a time at a consulting firm years ago before they were married — as well as to fulfill personal goals. Geisenheimer left Nazem, which was involved in venture-capital investments, to focus his efforts on buyouts, which he prefers.

For Goodrich, who worked at Citibank early in her career, it was a chance to return to finance. In addition, she says, she wanted to be part of a smaller company “to have much more control over my destiny. I made a lot of contacts in my 15 years in communications and felt I could really [take advantage of] those connections. With buyouts exploding, it just seemed to make sense.”

Goodrich and Geisenheimer got to know Cassidy through a fellow Wharton alumnus. “Martha fits in here perfectly,” says Geisenheimer. “She’s a great partner and comes with a strong background in the buyout industry.”

Geisenheimer calls his wife his “major adviser” and jokes that “we have an enormous philosophical commonality of view about many things, as long as we don’t talk about politics … Susan’s skills on the people side are very strong. I tend to have skills on the technical side.”

![]()

Antoine Drean, WG’92, and Bruno Ladriere, WG’92, are close friends, which is why they were able to go into business with one another and then split up, with no hard feelings.

Drean is a born entrepreneur who at age 23 ran his own mergers-and-acquisitions firm in his native France before entering Wharton. After completing his MBA requirements, he was so eager to start another company that he flew back to Europe without attending graduation ceremonies.

“When you are an entrepreneur and you take off two years for studies, you want to rush,” says Drean. “I finished exams and got back here.”

The company that Drean founded in 1992, Triago S.A., handles private placements, mainly for private equity funds, in both primary and secondary markets. Drean had discussed his plan to start the company with Ladriere and another student, Nicola Topiol, WG’91. Drean’s idea was to bring both classmates with him, but he felt compelled to hire non-Wharton folks. “Wharton MBAs can be too expensive,” Drean says with a laugh.

The company that Drean founded in 1992, Triago S.A., handles private placements, mainly for private equity funds, in both primary and secondary markets. Drean had discussed his plan to start the company with Ladriere and another student, Nicola Topiol, WG’91. Drean’s idea was to bring both classmates with him, but he felt compelled to hire non-Wharton folks. “Wharton MBAs can be too expensive,” Drean says with a laugh.

Topiol, who works in the United States, never did join Triago full-time, although he continues, on a part-time basis, to help Drean find business. Ladriere, who became a consultant after graduation, eventually joined Triago as a partner in 1993, but only after it was clear that the fledgling firm had gotten on its feet and could provide Ladriere with a steady paycheck. That decision underscored an essential difference between the two men.

“Antoine is an entrepreneur by nature,” says Ladriere. “I’m more risk-averse than Antoine. I’m more comfortable in a large group. Entrepreneurs tend to be perfectionists and you can’t grow a firm without being an entrepreneur. I was probably more nervous than he was [at Triago].”

Ladriere left Triago in 1997 to become an investment officer with the agro-food team at Paribas Affaires Industrielles, the principal investment branch of Bank Paribas in France. Still, Ladriere enjoyed his four years at Triago. “It was a very valuable experience in that you’re on the front line,” Ladriere says. “You don’t have a parachute.”

In addition, there were the benefits of working with a friend. “We had a very good atmosphere,” Ladriere says. “We had the same sense of humor, which is important. It’s important to work with somebody you like, who shares values, culture and a common background.”

Ladriere also came to understand the potential pitfalls of being in business with a friend.

“Your friendship may impact your professional relations,” he says. “Sometimes it’s good, sometimes not as good. If you disagree with somebody who is a friend, you may think that your business conflict will impact your friendship. And that’s not easy to deal with because he’s a friend.”

Ladriere’s departure was amicable. He never had a written contract with Triago; his arrangement with Drean was based on a handshake. He and Drean remain fast friends and see each other regularly.

“Bruno knew everything about our investors and our sectors, and I trust him today,” Drean says. “That’s because I know Bruno well and because we share the same ethics.”