THOUGHT

The Pros and Cons of High-Deductible Health Plans

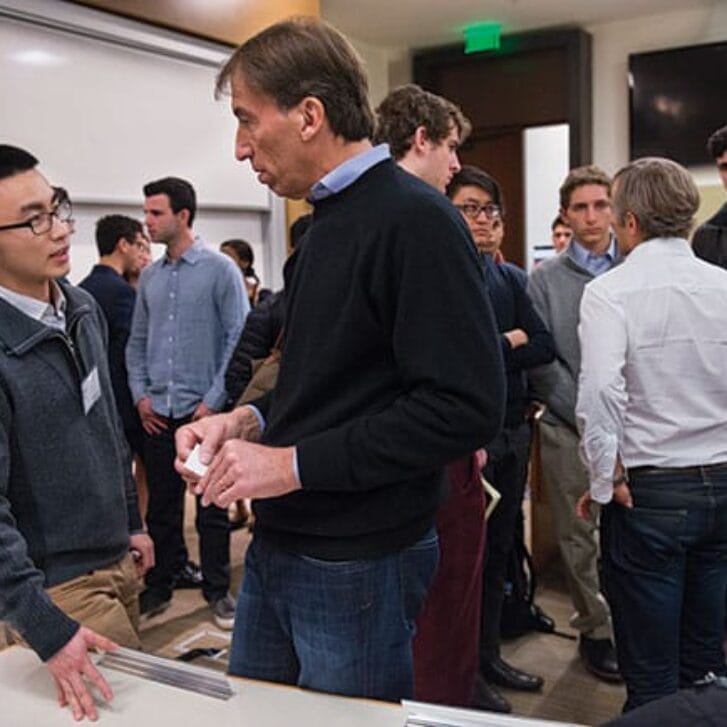

For a growing number of Americans, high-deductible health plans are a fact of life. At many firms, they’re the sole form of health insurance offered. The assumption is that if employees have to fork over more money when seeing a doctor or filling a prescription, they’ll use their benefits more selectively. Wharton health-care management professor David Asch gives the example of going out to dinner on your own dime versus an expense account. “People think more carefully when they’re spending their own money,” says Asch.

The IRS currently defines a high-deductible health plan as one with a deductible of at least $1,350 for an individual or $2,700 for a family, according to healthcare.gov. Many deductibles are in the range of $5,000 to $6,000, says Drexel professor of health management and policy Robert I. Field, who also is a Wharton lecturer. On the positive side, people’s monthly premiums are typically lower with such plans.

Wharton health-care management assistant professor Atul Gupta notes that employees and unions have pushed back on such plans because of their high cost to consumers. “People really resent those plans where they feel that it looks like insurance, but it really isn’t because you have to put up so much of your own money,” Field adds.

Gupta, Field, and Asch all believe that these plans may hold promise for reducing America’s breakneck medical spending, but not significantly—at least, not in their current form. While research has shown that people do cut back on care, “The reduction isn’t very large—it’s on the order of five percent to 10 percent,” says Gupta. All three also note that the effectiveness of the plans can hinge on whether employees are well-off or low-income, younger or older, healthy or living with chronic conditions. “If you have diabetes or high blood pressure or cancer, you’re almost certain to have to lay out the entire deductible,” says Field.

Some firms help employees by also offering tax-sheltered health savings accounts, either contributed to by the employer or not. Generous HSA benefits can make a big difference in how effective a plan is, says Asch. But plans that aren’t combined with such arrangements suggest pure cost-shifting: “The plan costs [the company] less; it costs the employees less, but then they get an unpleasant surprise at the end.”

Looking to the future, Gupta thinks high-deductible plans are here to stay: “I think the challenge is, we still don’t know how to make them truly efficient.”

THOUGHT

“If we reduce the amount of compliance and oversight necessary to be a publicly traded company in the U.S., that will increase volatility, because it’s the type B firms that are going public now.”

Wharton associate accounting professor Daniel Taylor on a Securities and Exchange Commission proposal to exempt relatively small firms from independent audits to verify their internal controls. The SEC’s objective is to increase the number of publicly traded companies by lowering the cost of going public.

(Illustrations: Invincible_Bulldog)

DATA INTERPRETED

$1,200

Approximate amount Amazon is expected to spend annually on each employee participating in a new six-year training program

Amazon recently announced plans to dedicate more than $700 million to educate 100,000 employees for a range of highly skilled roles. The move, which was announced amid scrutiny of the company’s workplace conditions, could trigger similar efforts at other businesses. “It’s going to be a lot easier to go to my CEO or CFO and say, ‘I think we should invest in training,’” says Wharton associate management professor Matthew Bidwell.

THOUGHT

“The person who understands data and can explain it to business? That’s the unicorn. That’s the hardest skill to hire for.”

A. Charles Thomas, General Motors’s first-ever chief data and analytics officer, offered this insight at the ninth annual “Successful Applications of Analytics” conference hosted by the Wharton Customer Analytics Initiative. It’s not so hard to find data scientists today, he said; what’s hard is finding ones who can clearly communicate the nature and value of data and analytics.

DATA INTERPRETED

56%

U.S. workers aged 50+ who reported being laid off or pushed out of a job

News organization ProPublica and think tank Urban Institute analyzed data from the U.S. Health and Retirement Study between 1992 and 2016. For older workers who may have suffered discrimination, it’s “very easy to blame yourself, to lose confidence,” says Stew Friedman, director of the Wharton Work/Life Integration Project. But when considering a second act, it’s important to do an inventory of “what you know, what you’re good at, what you’ve accumulated in terms of the value you have,” he adds.

DATA INTERPRETED

$700 MILLION

Maximum amount credit reporting firm Equifax agreed to pay for one of the largest data breaches in history

David Zaring, Wharton professor of legal studies and business ethics, says the 2017 breach—which affected roughly 147 million people—highlights the need for a more proactive U.S. regulatory approach, with “federal privacy legislation that would set forth what we expect from these companies and hold them accountable for the many failures in this area.”

Published as “Knowledge@Wharton—Data” in the Fall/Winter 2019 issue of Wharton Magazine.