With Christine Lagarde leading the International Monetary Fund (IMF) and Mario Draghi as president of the European Central Bank (ECB), there is a significant opportunity for decisive and bold action to break away from incrementalism regarding the eurozone debt crises. These leaders have made it clear that they have the firepower and will to lead the eurozone, but that they need the national governments to help them take actions to assure global capital markets that the EU will not only survive but thrive.

It seems like every month sheds more light on the fragility of the European fiscal situation. Attempting to address this problem country by country will marginalize the effectiveness of the effort and continue to degrade global capital markets’ confidence in the entire EU future.

The principles of global risk management call for comprehensive and common sense solutions that will allow the EU to settle into a gradual period of deleveraging and economic stabilization.

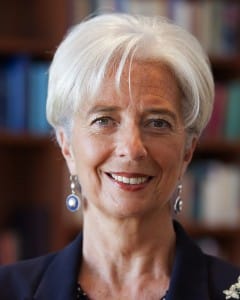

Christine Lagarde, managing director of the IMF

To succeed, we must first move from denial to risk awareness. The patients are not simply ill; they are ill with a virus pandemic. And the virus has spread to Ireland, Greece, Portugal, Italy and now Spain. As with any pandemic, those who have not caught it yet are possessed with irrational fear of contamination. The direct consequences: Less-troubled countries overreact and discriminate against sick countries instead of addressing the root cause.

Instead, they should attack the problem at two levels: first, by recognizing the interdependencies across countries and acting upon them; second, by putting the sick patients in quarantine. This will help stop the spread and get the patients on a path to recovery.

The first proposal relates to the formation of a centralized EU banking union. Interdependent risks require more global answers. A centralized banking union will allow global capital markets to back the ECB because they will be assured that leadership is there and willing to act.

The second proposal is more controversial but will bring significant benefits—bundle Greece, Portugal and Ireland (and maybe others) into a second currency, call it the Euro II (E2), and allow those countries to use a powerful tool of economic and financial stabilization: currency devaluation. Using the Euro II for a period of time will mitigate the principle risk any single country exiting the euro would likely face: being attacked by global capital markets and facing severe and lengthy economic issues.

These coordinated actions will help convince the troubled countries that they are not being pushed outside of the European Union. Meanwhile, the IMF and the ECB would issue new (and substantial) credit enhancements to the E2 countries to allow them to issue debt while attacking their fiscal issues. Each of these E2 countries would gain from the diversification benefits, and global capital markets would have a new currency to trade and hedge. The size and economic diversification of the Euro II would provide considerable liquidity. Further, the ECB “put” would help these countries obtain credit and prevent catastrophic currency devaluations.

Mario Draghi, president of the ECB

After their fiscal health has measurably improved, the countries in E2 would have an opportunity to convert to their own currency or (if qualified) return to a euro basis.

Decisive and coordinated moves like these may be the only way for the EU to maintain itself without centrifugal forces engulfing individual countries and dragging them into a black hole of severe economic and social disruption.

Will it be cheap? No. It will be expensive, but much less so than the series of one-at-a-time crises that have hurt the entire EU economically, politically and socially.

Lagarde and Draghi are a potent leadership team and should move forcefully to strengthen the EU and to convince global capital markets that they are back in the game. Our Euro II proposal will help them do just that.

Editor’s note: This blog is an adaption from a longer piece co-authored by Donald E. Callaghan, WG’73, an investment manager and founding principal of Hirtle, Callaghan & Co.