The scenarios are not pleasant: An earthquake that swallows up Los Angeles or a hurricane that destroys Miami and the southern half of Florida.

The image is enough to send tremors through the U.S. insurance industry — with good reason. In the past few years, catastrophic events have occurred with more frequency and severity — and at greater cost to insurers — than ever before: Hurricane Andrew in Florida in 1992 (insurance claims, $15.5 billion); the Northridge, Calif., earthquake in 1994 (insurance claims, $12.5 billion) and the Kobe earthquake in Japan in 1995 (insurance claims, $1 billion but costs of uninsured repairs estimated at $100 billion). In the aftermath of Hurricane Andrew alone, nine U.S. insurance companies filed for bankruptcy.

Up until now, property and casualty insurers have protected themselves by buying policies from reinsurance companies designed specifically to cover losses from a catastrophic disaster. But these kinds of disasters have traditionally been defined as anything involving claims up to $1 billion. The magnitude of events since 1992 clearly exceeds that figure.

“Insurance companies got a big shock with Hurricane Andrew,” says Neil Doherty, Ronald A. Rosenfeld Professor of Insurance and Risk Management. “They realized that a single catastrophic event could lead to phenomenal bankruptcies.”

Just look at the numbers. America’s insurance industry holds approximately $250 billion in equity. Yet given substantial increases in populations and property values in hazard-prone areas, “it’s not unrealistic to expect that one major catastrophe could result in $70 billion or even $100 billion of claims,” says Howard Kunreuther, Cecelia Yen Koo Professor of Decision Sciences and Public Policy and Management, and co-director of Wharton’s Risk Management and Decision Processes Center.

Other experts estimate that a repeat of the earthquake that destroyed Tokyo in 1923 could result today in damages of between $900 billion and $1.4 trillion.

“When the question is raised as to whether the insurance industry can pay for ‘the big one,’” says Peter Burns, project director of Wharton’s Catastrophic Risk Management program (see box), “the answer is clearly no.”

According to a growing number of experts, relief for the insurance industry lies in securitizing catastrophic risk — i.e. packaging it in the form of securities which are sold to private investors ranging from pension funds to hedge funds to sophisticated individuals.

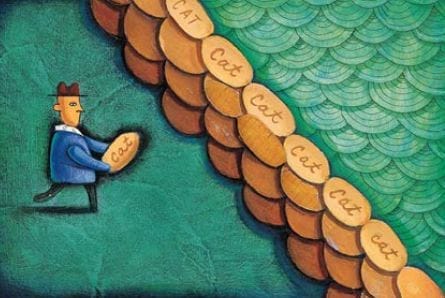

The more popular offerings include catastrophe (“cat”) bonds (also known as Act of God bonds), cat options and catEPuts (catastrophe equity puts), but there are other approaches as well, such as reverse convertible debt and a catastrophe insurance risk exchange. Taken together, these various instruments — all of which offer different combinations of risk and reward to investors, depending on how they are structured and priced — are seen as potentially revolutionizing the insurance industry’s approach to catastrophic loss.

The idea is to shift the risks, and costs, of a major catastrophe from the backs of insurers/reinsurers to the heftier shoulders of the capital markets.

Once again, the numbers tell the story. “Say a major hurricane strikes Charleston, S.C., and causes $80 billion in damages,” says Doherty. “That would obviously have a very adverse effect on the industry’s $250 billion equity pool. The capital markets, however, represent a $19 trillion investment pool. What would be devastating for the insurance industry would be a drop in the bucket for the markets. So why not invent capital market instruments that would be a better way of spreading the losses incurred by that hurricane?”

The point has not been lost on many of the parties involved, including insurers, reinsurers, investment banks, commercial banks and brokers. Swiss Re, Goldman Sachs, Lehman Brothers and Merrill Lynch have all worked on cat bond issues; Goldman Sachs and Lehman Brothers recently opened insurance arms; and large international reinsurers are establishing their own capital markets divisions.

“The financial services market is undergoing a convergence that will involve commercial and investment banks getting into insurance, and insurers getting into the banking and investment business,” says Norman L. Rosenthal, W’73, WG’76, PhD’78, a Philadelphia-based consultant and chairman of a capital markets advisory board at insurance broker Aon. “These are trends that will lead to the more efficient use of capital and new ways to better manage risk.”

“The traditional view of insurers is that they underwrite people,” says J. David Cummins, Harry J. Loman Professor of Insurance and Risk Management. “They look at your risk characteristics and they either want to insure you or not, for a set premium. But what we are talking about here are totally anonymous financial contracts. It makes no difference who the buyers and sellers are as long as they meet the solvency criteria of the exchange. It’s what makes this capital markets approach the most innovative idea in the insurance industry in the last 200 years.”

Faced with the grim prospect of severe loss of surplus or even insolvency, the insurance industry has been transforming the way in which it absorbs risk. Among its strategies: new catastrophe reinsurers in Bermuda that are better equipped to handle cat losses; increased consolidation among reinsurers; new state insurance programs in Florida (the Florida Catastrophe Fund), California (the California Earthquake Authority) and Hawaii; an insurance swap market (CATEX) to allow for better geographic diversification of disaster risk, and various excess-of-loss reinsurance programs around the world to better diversify claims.

Within the context of these various loss containment strategies, capital market instruments play an interesting role. On the one hand, some experts see them as forever changing the industry’s approach to risk management. On the other hand, they are also considered a complement to, rather than a substitute for, more traditional defenses.

The reinsurance industry, notes Anthony M. Santomero, Richard King Mellon Professor of Finance and director of the Financial Institutions Center, “is defined by long-entrenched customer relationships. Most capital market instruments like cat bonds are just the opposite. They are simple, specific, single-period assets … It’s clear that reinsurers see cat bonds both as competitors but also as complements — i.e. a potential way for them to expand their own capacity to take on risk.”

If reinsurers knew, for example, that they were covered for a huge catastrophe — either because they can lay off some of the risk they have assumed or can arrange for their customers to be able to access the capital markets directly — “they would be freed up to write more conventional reinsurance,” Santomero says.

In any case, most experts agree, it’s too soon to say exactly how these financial instruments will evolve. It was only five years ago that the Chicago Board of Trade (CBOT) first introduced catastrophe (cat) options as a way to tap into the capacity of the capital markets. Investors “trade on an industry-compiled index of cat losses that is based on events such as hurricanes, earthquakes, windstorms, ice storms, anything that could cause major losses,” says Cummins. “If no disaster occurs, the investor makes money. But if the index goes above a certain level agreed on in the contract, it triggers the option.”

The market for this instrument, however, has tended to grow slowly, for several reasons. “The liabilities on the options could be high if a huge hurricane occurred,” notes Doherty. “Also, investors are used to looking at such criteria as a company’s balance sheet or anticipated changes in interest rates. They are not experts on storm occurrences.” Finally, insurance companies themselves haven’t always seen cat options as a good bet. “After all, it’s not the insurance company’s own loss that determines whether it gets paid, it’s the whole industry’s losses,” says Doherty. “If one particular company got hit harder than others, the payback might not be sufficient to cover its claims.”

The next major innovation — and one that seems to be enjoying a recent surge in popularity — was cat bonds. Six issues worth a total of $1.1 billion have been offered since 1994. The latest was a $100 million bond issue in November from Tokio Marine & Fire, the biggest a $477 million issue from USAA in June 1997.

The idea is that investors buy bonds from an insurance company (or more accurately, from a reinsurance company set up offshore specifically for this transaction). If no major catastrophe occurs during an agreed-upon time period, investors get their money back with interest high enough to reflect the riskiness of the investment. If a catastrophe of a certain size does occur, the insurance company can use the investors’ money to pay out claims. In that situation, and depending on how the issue is structured, investors lose all or part of their principle and/or interest.

“We expect a substantial growth in the next couple of years in the cat bond area,” says Robert H. Litzenberger, WG’66, managing director, Goldman Sachs, and co-leader along with Merrill Lynch and Lehman Brothers on the $477 million USAA bond issued in June 1997, “mainly because there is very limited capacity for supercat events in the reinsurance industry.

“USAA’s exposure to hurricanes is generally on the East coast, particularly in southeast Florida,” says Litzenberger. “The company views the cat bond issue as a way of purchasing more reinsurance protection than it normally would. It is a complement to their insurance package, not an alternative.”

The one-year $477 million USAA bond issue has two layers of debt, a principle protected part and an unprotected part. If a certain category of hurricane hits the East Coast and causes at least $1 billion of damages (the figure can vary depending on how the bond is structured), the protected class is guaranteed its principle back but loses its interest for up to 10 years. The unprotected class starts to lose principle at a $1 billion loss to USAA and loses its entire principle for losses in excess of $1.5 billion.

The USAA bond, which ran out in June during a year of no major hurricanes, paid a return of about 11 percent to its investors.

The issue was “several times oversubscribed,” says Litzenberger. “The original intent was to have a $100 million issue. Based on initial investor response, USAA increased the amount of risk coverage to $400 million and demand for it was about $1 billion … Relative to high yield debt issues that have similar levels of principle risk, such as BB rated debt, it had a high coupon.” (The $477 million issue included $400 million of risk protection; the remainder was principle protected).

“There is an interesting story connected with the issue,” notes Litzenberger. “The reason there are more intense hurricanes in southern Florida than in New England is because the water temperature is higher. This was an El Nino year, which produced higher ocean temperatures, but El Nino also tends to produce shearing winds that break up tropical waves before they can form into hurricanes. This had happened during the previous El Nino in 1982. Some investors knew that, increased their holdings and decided to bid up the price of these bonds because they figured the hurricane risk would be less than usual. Also, after the hurricane season ended last fall, many people sold out and took their profits.”

Goldman was co-leader with Swiss Re on the smaller, $100 million Tokio Marine & Fire issue, also oversubscribed. This bond was not indexed to the actual losses from a catastrophic event, as the USAA bond was, but to the location and intensity of an earthquake in a precisely defined area around Tokyo.

Peter Bouyoucos, WG’85, head of Morgan Stanley’s insurance capital markets group, is another proponent of cat bonds. His group’s overall focus has been to develop broad-based capital market risk transfer alternatives to the reinsurance of property, life and credit exposures.

Two years ago, Morgan Stanley was senior underwriter for what would have been a path-breaking $1.5 billion cat bond issue — larger than all the other issues combined — for the California Earthquake Authority. Investor Warren Buffet’s National Indemnity Co. showed up at the last minute and insured the risk instead.

Since then, Bouyoucos and his group have made progress on a number of other deals to take advantage of what he predicts will be an upturn in the market. “The pipeline of projects we have, and I am sure our competitors have, is significantly greater than the number of deals you have seen,” Bouyoucos says, noting the time he has spent with ratings agencies and risk modeling firms, and the visits he has made to hundreds of investors in the U.S., Europe and Asia. “The risks we are trying to package are new and different. It means that everyone has needed time to get up the learning curve …

“The difficult part about these deals is getting across the finish line,” Bouyoucos adds, “because at the moment there isn’t an absolutely compelling need for insurance companies to issue bonds given the affordability of more traditional means of reinsurance.

“Three years ago, in the aftermath of Hurricane Andrew and the Northridge earthquake, the availability of reinsurance was tight and prices were high. But since then, there have been very few catastrophes of any real magnitude. Consequently prices have come down about 15 percent per year over the last three years. As the prices come down, the amount of available capacity has increased. So from a competitive perspective, trying to develop a new marketplace has been a little more difficult…

“For now at least, reinsurers and the capital markets can reasonably coexist,” Bouyoucos adds. “The ability of reinsurers to provide protection for their longstanding relationships with insurers can be increased through capital market instruments as needed. In fact, reinsurers, through their ability to aggregate and transform risk, may be the ultimate source of capital market securitizations.

“At the end of the day I expect that companies who want to optimize their risk management program will be looking at all different types of alternatives. The right answer will be a combination of the capital markets, traditional reinsurance and risk financing.”

If cat bonds are considered high-risk, why are investors so interested? “Because it’s what financial people call zero beta asset,” says Cummins. “The bond is uncorrelated with the market, so it is a great instrument for diversification. Taken in a small enough proportion it actually improves your risk return profile.”

Yet cat bonds, as innovative as they seem, aren’t for everyone, including some insurers. First, because cat bonds are so new, there are no standards or ratings for evaluating the quality of a particular instrument. “Once these bonds are rated as other financial instruments are, they are likely to be more popular with investors,” notes Kunreuther.

Second, “some insurers say they value their relationships with their reinsurers, and they are reluctant to give them up,” says Cummins. “That may be true, but in addition to the fact that there isn’t enough capital to cover catastrophes, the reinsurance market is cyclical. It goes through periods of high prices; high prices are most likely to occur after a Hurricane Andrew type of event, which is when an insurer needs lower prices the most.”

Then there is always the chance that a particular investor or class of investors might buy in shortly before a huge earthquake hits San Francisco. It’s one reason these bonds are billed as only appropriate for sophisticated investors. “Anybody would be foolish to put half their wealth in a single cat bond,” notes Litzenberger. “But when you talk about two to three percent of your portfolio, that’s a relatively small and controlled exposure.”

In a recent study of catastrophe hedging instruments, Doherty looks at the more familiar reinsurance strategies as well as some of the newer instruments like cat options, cat bonds and CatEPuts.

Each of these approaches, Doherty says, offers a different combination of credit risk, basis risk (the potential mismatch between the payout on the contract and the hedging insurer’s actual losses) and moral hazard (the natural incentive of the insurer to exercise less control over underwriting and loss settlement because of reinsurance protection).

“It is incumbent on the primary insurers to determine exactly what tradeoffs they want to accept,” Doherty says.

While Doherty himself believes that no particular instrument will dominate the market, the choices at the very least “offer insurers a richer portfolio of risk management strategies … Just like with derivatives, the evolution of the market will bring a broader, not narrower, array of instruments to bear.”

Meanwhile, some observers are also predicting an eventual “unbundling of insurance products, with insurers retaining marketing, underwriting and settlement services, while risk-bearing bypasses the reinsurance industry and is being provided more directly from the capital markets,” Doherty notes. “I have some mixed feelings about this. It makes sense in some cases and not others. Once you start separating out parts of the contract, for example, you start changing incentives, which can be disastrous. It’s an area to look at with caution.”

Up until recently, insurers, reinsurers, financial institutions, government agencies and disaster-prone communities had to rely on historical data to estimate the likelihood of an earthquake or hurricane and also the level of damages.

That is no longer the case. Today, a number of firms offer sophisticated catastrophe models that, when measured against actual events, have proven to be remarkably accurate.

A catastrophe model uses data bases and computer programs to analyze the impact of different scenarios on hazard-prone areas. The information can be presented in the form of expected annual losses based on simulations over a long period of time or in the form of damages caused by a specific event (a worst-case disaster scenario.)

The impact of modeling on capital market instruments is already evident. For example, prices for cat bonds are now based in part on very detailed simulations of the effects of hurricanes and earthquakes in catastrophe-prone states such as Florida and California. “Using historical data, engineering studies, and so forth, these companies can simulate tens of thousands of events to eventually come up with estimates of how much damage would be done and what it would cost,” says Cummins, who along with Doherty is using simulations created by Boston-based Applied Insurance Research, Inc. for a study of basis risk.

“Until recently, insurers and reinsurers had a comparative advantage in information on catastrophic events,” Doherty adds. “But now a number of modeling firms have developed models that combine seismic and meteorological information with data on the construction, siting and value of individual buildings.

“More importantly, these models are now available to other companies and investors, which means the comparative information advantage of insurers and reinsurers is being eroded and the door is being opened to new players.” Adds Cummins, “we feel that the more information out there about the effectiveness of derivatives, the better for everyone.”

A key component of the research agenda is work being done by Kunreuther and colleague Paul Kleindorfer, Universal Professor of Decision Sciences, Economics, and Public Policy and Management, on risk mitigation measures (RMMs) — actions that reduce or eliminate the losses to individuals and their property from natural hazards. They can include everything from installing hurricane shutters and roof bracing to strapping down a water heater and bolting a structure’s side walls to the foundation.

Mitigation, Kunreuther notes, affects both the reinsurance market and capital market instruments. For example, insurers who successfully encourage homeowners to adopt mitigation measures should benefit from lower reinsurance costs because of the anticipated reduction in losses from catastrophic events.

As for capital market instruments, “as you reduce your losses through mitigation, two things happen,” Kunreuther says. “One, the need for these cat bonds is somewhat circumscribed because you have reduced the potential for catastrophic losses. Second, mitigation lessens the uncertainty surrounding these losses because of a better understanding of what may happen after a disaster. So it should not only be easier to price cat bonds, but the cost to insurers and reinsurers will also be lower because the damages and uncertainty have both been reduced.”

Cat issues, while they cover a very small part of the worldwide catastrophic risk market, are most likely here to stay, and to grow.

“Obviously a big catalyst to this market would be another major storm,” notes Frank S. Wilkinson, WG’65, executive vice-president of insurance broker E. W. Blanch Co., which has a unit dedicated to capital market products. “With the contraction of the traditional market, that would be a time for the capital markets to come in.”

In the meantime, adds Cummins, “some insurers remain a little resistant to the concept, and I would agree that a certain amount of caution is warranted. But my view is that this new market, if not revolutionizing the industry now, will do so in 10 years. Somewhere along the way, insurers will come aboard.

“One of the things that convinces me of the market’s viability is that almost all of the major reinsurance companies are now gearing up for cat bond issues.

“It would be a mistake to say that financial instruments will replace reinsurance, but I can see them absorbing bigger and bigger proportions of the traditional reinsurance market.”