When Witold J. Henisz was a boy, his parents told him stories–stories of what it was like to live under communist rule in Poland. His mother and father, both physicians, eventually left their native land, but only after years of waiting for the right opportunity.

The government, not wanting a brain drain to the West, made it difficult for citizens, especially professionals, to leave the country. Henisz’ parents were restricted to traveling separately to medical conferences.

“Then, after a couple of years of going abroad, they were allowed to travel together,” says Henisz, assistant professor of management. “They drove down from Poland to meet a friend in Italy and left from Italy to JFK (airport) in New York.” They had $100 in their pockets.

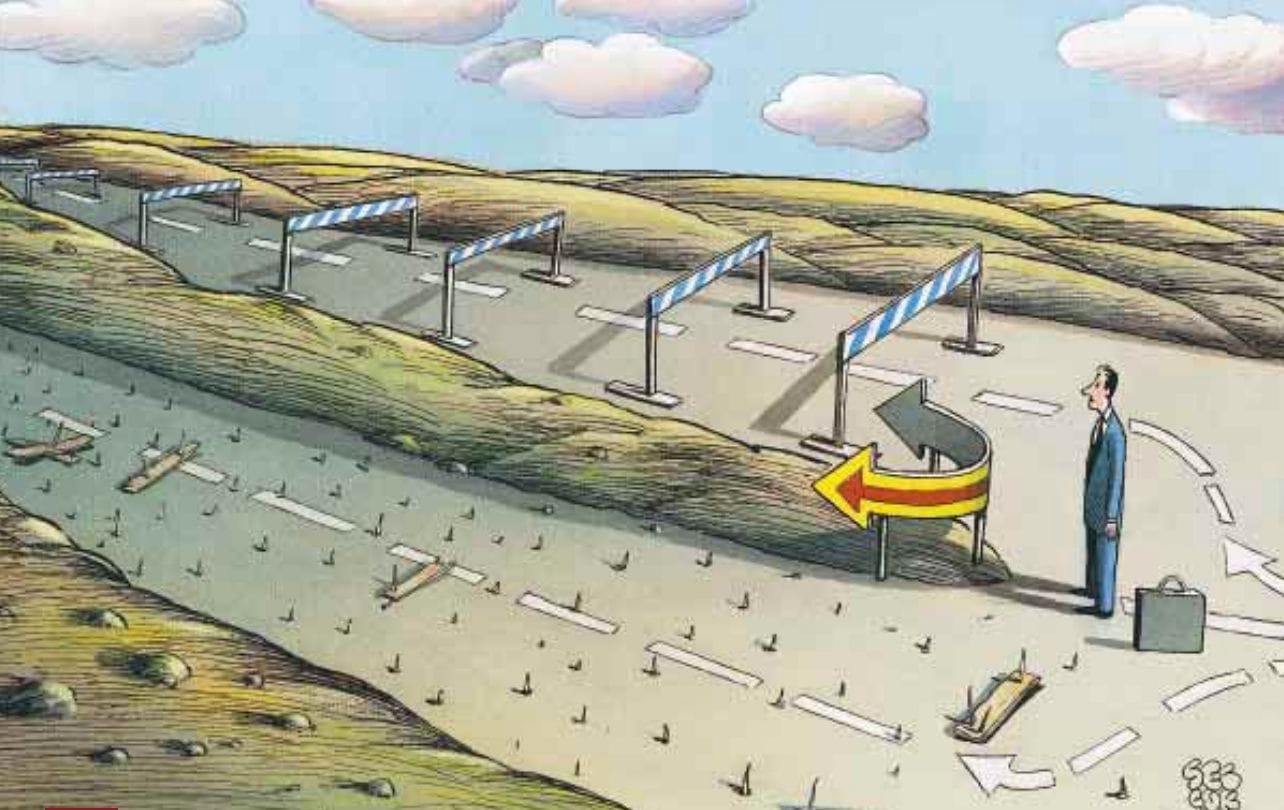

That was in 1969, when Henisz (pronounced HEN-ish) was a little more than a year old. In the years that followed, his parents told him tales of how Poland’s command-and-control economic system was stifling. “It was a very strong recurring theme about how incentives weren’t provided by the system,” Henisz tells a visitor at his office in Steinberg Hall-Dietrich Hall. “The government could backtrack on anything it said, and it could be arbitrary in its behavior. There was this filter that everything sort of had to travel through within the communist party’s view before it could get to individuals, and that imposed distortions.”

It is not surprising then that Henisz – who joined Wharton in 1998 and is known by the nickname Vit (pronounced VEET) – today devotes his research to the topic of political risk. Henisz, who earned a doctoral degree at the University of California at Berkeley in 1998 after working for a time at the International Monetary Fund in Washington, analyzes how arbitrary government actions can wreak havoc on businesses that invest large sums of money in countries other than their own.

Much At Stake

Henisz says much is at stake for firms that fail to conduct thorough political-risk analysis. In a paper titled “Political Risk and Infrastructure Investment,” Henisz and co-author Bennet A. Zelner, of the McDonough School of Business at Georgetown University, cite World Bank figures showing that infrastructure spending in developing countries exceeds $200 billion a year.

But foreign businesses are having trouble making profits in these markets. The authors point to a report by Merchant International Group, a risk consultancy based in the United Kingdom, which surveyed 7,500 multinational corporations and found that 84 percent of their operations spawned in emerging markets from 1995 to 1998 failed to meet financial targets. Risks in emerging markets cost multinationals an estimated $24 billion in 1998 alone, or between eight and 10 percent of total expected returns.

“A huge amount of financial resource and management time is lost each year as a result of inadequate research and analysis prior to embarking into a non-domestic market,” the Merchant study notes. It goes on to say that techniques for “identifying and evaluating hidden risks will need to become more sophisticated.”

Henisz’ work is intended to aid companies in honing their risk-analysis techniques. His research is based on in-depth analyses of electricity generation and telecommunications, but is applied to a broad range of manufacturing and service industries. Risk analysis is especially critical in those two industries because forays into foreign markets involve large sunk costs, substantial economies of scale and pricing structures that can become highly controversial and politicized.

The concept of assessing political risk is nothing new to corporations. If a firm is considering investing in a foreign country, its leaders want to know everything they can about the national and local governments with which they will have to deal. A company wants to be able to assess with the highest degree of certainty the stability of current policies and how likely they are to change.

Traditionally, firms have analyzed political stability by examining macroeconomic factors, such as the rate of economic growth or unemployment; by using political science measures, such as democracy or stability; or by relying on the subjective judgments of how managers perceive risk in a given nation.

A New Approach

A New Approach

What makes Henisz’ research different is that it aims to quantify — in an objective, consistent and internationally comparable way — how risks vary from country to country. Specifically, Henisz explores how easy or difficult it is for governments to change policies. In addition, if a government does change a law or regulation, Henisz says investors need to know whether the shift will be beneficial or harmful to them. His work, with Zelner’s, addresses this issue too.

“Researchers have increasingly focused on the question of credible commitments by governments in the past five to 10 years, but the tools to measure this commitment haven’t existed,” Henisz explains. “Researchers have latched onto certain measures, such as whether a country is democratic or autocratic. But some democracies can be really unstable and some autocracies can be relatively stable and really friendly to investors.”

He says Russia, which has a strong democratic constitution but is characterized by extreme political uncertainty, is an example of how even a democracy can pose challenges to potential investors seeking a certain amount of political consistency. On the other hand, Singapore is a non-democratic nation but is considered investor-friendly.

Another related way that researchers have tried to assess risk is by determining whether governments are stable or not, regardless of whether they are democracies. Intuitively, one would think that a country where the government changes hands frequently would be a poor place to invest. But there are shortcomings to this way of thinking as well. By this measure, Italy would appear unstable. But Italy is certainly a safer place to invest than, say, the Democratic Republic of Congo (formerly Zaire), which went through a decades-long period where its autocratic regime remained intact.

A third method traditionally used to assess risk is to survey managers and ask them where they perceive risk to be. A firm may simply ask about the likelihood that a government will renege on a contract. Or, it could inquire whether a government is prone to raising taxes at a moment’s notice.

“On one level” Henisz says, “this approach is great. You’re asking the exact questions you want answers to. But if you’re trying to explain what part of the government is causing problems, you don’t really know.” In addition, the information is subjective and fraught with inconsistency.

Each of these traditional methods has shortcomings. First, they are primarily retrospective in nature. Macroeconomic accounting measures or investors’ perceptions of risk may provide nothing more than superficial information about trends. For instance, an accelerating growth rate may prompt foreign investors to flock to a country to take advantage of its economic “miracle.” But if there has been no substantive political reform, the underlying political risk probably has not abated. Second, the macroeconomic statistics may be subject to manipulation by politicians and others in key posts.

Third, the political science measures are objective and do focus on political institutions, but not ones of interest to investors. The final shortcoming relates to perceptual assessments. While it is true that less investment occurs in countries perceived by managers to be risky, this tells managers nothing about the fundamental sources of risk.

In an attempt to fill these knowledge gaps, Henisz has developed a model that takes into account two key components of political systems.

The first is whether the system contains “veto points” – whether one part of the government can effectively act as a brake on the arbitrary actions of another by nixing a proposal. In the United States, of course, this is the system of checks and balances.

Second, Henisz factors in whether these veto points are actually put into practice. Often they are not. Some African countries have constitutions, modeled on those of Western nations, that appear to have a robust system of political constraints. But the checks and balances exist only on paper. “You may look at the Supreme Court and find that everyone was appointed by the sitting president,” Henisz says. “Or you look at the legislature and find that everyone is a member of the same party as the president.”

Henisz has assembled data for countries around the world and computed a measure of how easy it is for governments to change policies based on their policy-making structures. “I’m interested how credible governments are and this is a measure of credibility,” says Henisz.

Henisz calls the model a “political constraint index.” It takes into account the number of veto points in a country’s political system — its executive branch, upper and lower legislative chambers, judiciary and sub-federal institutions. First, Henisz computes a measure of how policies are likely to change simply on the basis of the number of veto points. He then takes this initial measure and goes a step further. He adds such factors as which political parties control the different branches of a country’s government and the history of the political affiliations of jurists who have been appointed to its high court.

The index has been calculated for virtually every nation in world from 1960 to 1998. A high number, such as 0.85 for both Switzerland and the United States, means a nation’s political system has many constraints. Thus, politicians are less apt to behave capriciously, which is good for investors. A low number, 0.18 for Togo or 0.00 for Afghanistan, means the governing regime has few political constraints, and thus may pose serious risks for investors. Says Henisz: “Whoever is in power could wake up tomorrow and say ‘I’m going to double taxes and there are no courts or legislature to say ‘You can’t do that.’ ”

The table also reveals how certain countries have developed systems with many more political constraints than they once had. In Henisz’ native Poland and other nations in Eastern Europe, such as Hungary and Bulgaria, much progress has been made since the fall of the Soviet Union a decade ago.

In conducting their research, Henisz and Zelner spent considerable time with political risk analysts at several companies that have invested large sums of money in infrastructure investments overseas, including Enron Corp. and Duke Energy International, in an attempt to understand the full array of risks they face. These companies and others go to great lengths to assess political risk and have considerable experience in investing wisely. But Henisz says companies can also be arbitrary in the way they combine their information, and thus can miss some important trends.

How One Company Got Blindsided by Political Risk

Witold J. Henisz tells the story of Houston-based Enron Corp., which has had much experience building power-generating facilities around the world and dealing with the attendant risks. In 1995, Enron built its Dabhol Power Project in a relatively undeveloped region of India’s Maharashtra state, an area in dire need of electricity.

“Concerned about risk, the company designed a contract that was very advantageous to them,” Henisz says. “They were going to get paid a lot when the plant started producing electricity, and they were relatively well insured against the types of risks that they foresaw – exchange-rate risk and changes in demand. They had a lot of foresight and thought they had things pretty well covered.”

But there was an election in the state and the Hindu nationalist Bharatiya Janata Party, which was somewhat hostile to foreign investment in general, came into power. The party, angered by what it thought were the high prices per kilowatt hour charged by Enron, threatened to take over the project and send the company packing.

In the ensuing months, though, the deal was renegotiated, and in late 1999, Enron began phase two of the Dabhol project. In the end, both the company and the local government were able to work through their differences. But Enron learned a lesson the hard way.

“I think Enron didn’t take into account enough the power and autonomy that the state government had to block the project,” Henisz says. “There was nothing to act as a check against this new provincial government from halting Enron in its tracks. That was a classic example of a failure to understand some of the intricacies of the political system. If Enron had really looked at where the checks and balances were – who had the ability to stop the project and whether they could do so easily – they would have been more concerned about bringing in other parties, even the ones out of power, and making sure they were on board with them and working with them. Enron has since given these elements much heavier weight in their analysis and is an industry leader in the way they assess these questions.”

The Lessons of East Asia

The East Asia crisis is a good example. In 1996, economists and others heralded East Asia as a major success story. Japan, Taiwan, Korea, Indonesia and Malaysia were enjoying high rates of economic growth, and many people concluded that the Asian method of capitalism, in which governments and businesses work hand in hand, was superior to Anglo-Saxon capitalism, where government and business are often at odds.

“A lot of the subjective risk measures ranked East Asian countries as great places to invest,” Henisz recalls. “When I started constructing my measure and went out and talked to people about it, they said, ‘That’s interesting, but you can’t explain Asia.’ All of those countries were ranked low in terms of political constraints, but people said to me, ‘You’re missing something.’ ”

As it turned out, Henisz’ analysis provided prescience, even though he was just beginning his research. He was beginning to learn that political constraints in East Asian nations are few.

“The courts are relatively subservient and often can change quite rapidly in terms of who’s sitting on them in relation to who’s in the executive and the legislature,” he says. “The legislatures are frequently dominated by the party that controls the executive, so you very rarely see strong opposition parties. They were ruled almost as one-party states. There was an idea that government guiding business was a good thing, but it’s now what everybody is criticizing as crony capitalism. I was always a bit skeptical about the East Asian miracle.”

He continues: “There was early work by a lot of economists showing that it’s relatively easy for a country to catch up from being really far behind. Stalin and Krushchev were able to take a very agrarian state and develop it quite rapidly into something that was a seeming economic rival to the United States, because if you’re just catching up, you just copy what other countries have done. But maintaining and pushing that frontier and trying to develop new technologies is a much harder task. You’re much safer to rely on what the market tells you than what someone in the government bureaucracy tells you.”

Looking Ahead

Henisz’ latest research focuses on political factors that his current model does not take into account.

He is looking, for instance, at how electoral rules differ from country to country and can affect risk. The United States, for example, employs what are known as “first-past-the-post” rules: a congressional candidate who captures 51 percent of the vote in a district, for example, becomes the sole representative of all voters in that district. Other countries, however, have more pluralistic electoral systems whereby multiple legislators (and parties) can represent a district.

In the years to come, it seems, Henisz will devote much of his life trying to understand what his mother and father learned first-hand many years ago. “This notion of political risk is really important,” he says. “It was inculcated in me from an early age.”

A New Approach

A New Approach