(Illustrations by jamtoons)

CEOs are often thought to be more rational and objective than others, an expectation perhaps fueled in part by strong performance. But that isn’t actually the case, according to a paper titled “Behavioral Corporate Finance: The Life Cycle of a CEO Career,” by Wharton finance professor Marius Guenzel and Ulrike Malmendier of the University of California, Berkeley. In fact, according to the researchers, there’s now compelling evidence that managerial biases pervade every part of a CEO’s time at a company.

The Premise

Early behavioral research in finance assumed managers don’t succumb to common biases and systemic mistakes. This “rational manager paradigm” presumes that they:

Aren’t random samples of the population; they are smart and highly educated.

Aren’t random samples of the population; they are smart and highly educated.

Adjust after mistakes and optimize for the future.

Adjust after mistakes and optimize for the future.

Are kept in check by corporate boards and the market.

Are kept in check by corporate boards and the market.

The Pivot

A convincing body of evidence cropping up since the mid-to-late-2000s shows that decision-makers actually are subject to systemic and persistent biases, such as:

- Overconfidence

- Sticking to bad bets

- Relying on past experiences to inform decisions

The Findings

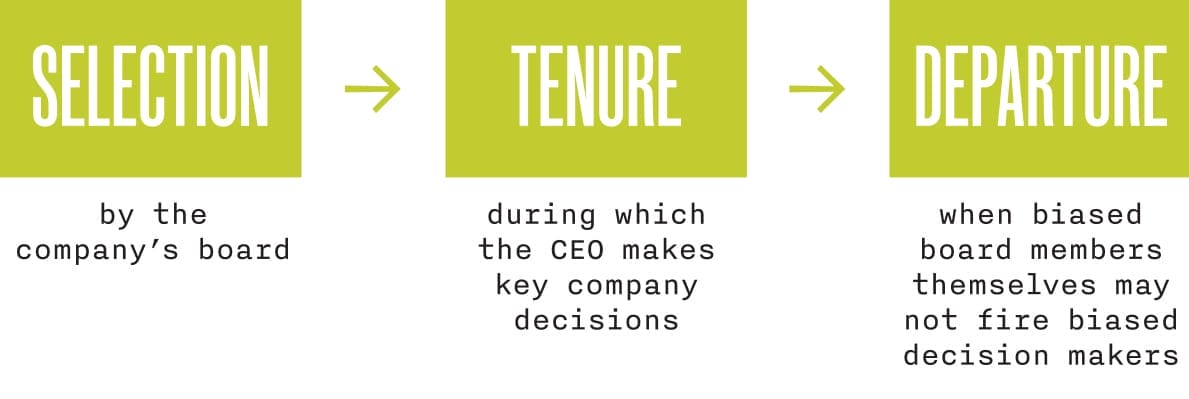

Through a review of the evidence, the researchers observed that bias affects every stage of a CEO’s appointment, including:

Key Takeaway

Behavioral biases affect “even the most sophisticated, most educated people,” Guenzel said in an interview on the Wharton Business Daily show on SiriusXM. “This really speaks to the hardwiring of biases in people and how biases are significant elements of human decision-making.” To counter biased decision-making, the paper suggests organizations could attempt “corporate repairs,” such as procedural changes or different hiring practices, and modify compensation bonuses to account for overconfidence or aversion to losses.

Published as “Are CEOs Less Influenced by Biases?” in the Fall/Winter 2021 issue of Wharton Magazine.