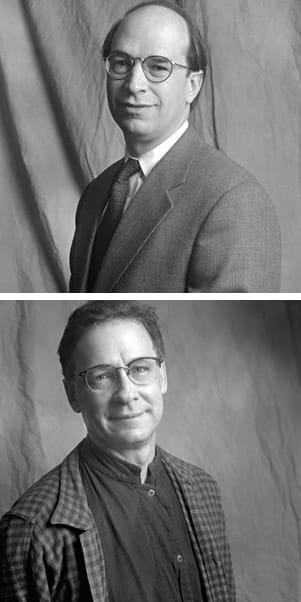

Wayne Silby and John Guffey didn’t invent social investing, but the two founders of the Calvert Group turned the concept mainstream.

Wayne Silby and John Guffey didn’t invent social investing, but the two founders of the Calvert Group turned the concept mainstream.

In the 1960s and 1970s, opposition to the Vietnam War, nuclear power, and other causes spread interest in social investment practices. Wharton classmates Silby and Guffey set out to identify similar companies in which maximizing shareholder value and optimizing social concern were concurrent in their missions and operations. In 1976, after Silby received his law degree from Georgetown University, the two founded the Calvert Group on those principles. In 1982, the Calvert Group introduced the first money market with a social screen and the Calvert Social Investment Fund—the first mutual fund explicitly excluding South African investments.

In the ensuing years, the company has continued to innovate, introducing the first socially screened bond fund (1987) and the first social global fund (1992). In 1990 the shareholders of the Calvert Social Investment Fund voted to place one percent of the assets of the mutual fund in below-market investments in local nonprofit financial intermediaries to support micro-credit, low-income housing, small business and other community development initiatives.

While Silby and Guffey sold the Calvert Group to Acacia Mutual Life Insurance Co. in 1984, they remain members of the board of the Calvert Social Investment Fund. In 1989, they joined two partners to turn to the direct investing through Calvert Social Venture Partners. The small venture fund has made investments ranging from an educational video producer for inner-city youth, a biomedical producer of a needle-free insulin delivery system, and a pharmaceutical company that develops drugs from tropical plants, tapping the knowledge of traditional medicine and compensating indigenous tribes in the process. Funding their initial scheme was problematic. Guffey told The Washington Post in 1989 that he thought social investing “is still not mainstream enough to convince large mutual funds to promote them.”

A lot has changed. According to the Social Investment Forum, total investments using at least one social investment strategy have grown from $40 billion in 1984 to more than $2.29 trillion in assets, according to the 2005 report by the Social Investment Forum (SIF). Social investments now account for about 13 percent of all money under professional management in the U.S., according to the SIF report.