Whartonites are renowned for their love of numbers, so let’s consider these. About 41.5 million people played fantasy sports in the U.S. and Canada in 2014, according to the Fantasy Sports Trade Association (FSTA). And based on FSTA numbers, Forbes estimated the total fantasy sports industry value—for just fantasy football, mind you—to be between $40 billion and $70 billion.

About 48.8 percent of Americans owned stocks, directly or indirectly, in 2013, according to the latest available annual stats on stock ownership from the Federal Reserve. Those numbers are down since 2007, sure, but that’s still roughly 155 million people invested, literally, in a stock market with a market cap north of $21 trillion.

Combine these two sets of numbers—the number of fantasy spots players and the number of Americans who own stocks—and what you get … quantitatively, I don’t know. But qualitatively, it seems like a great opportunity.

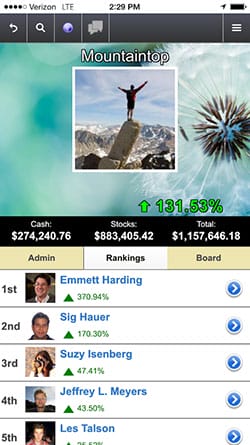

Laurence Cohen, W’00, and his lifelong friend Lewis Schlossberg see it—and have acted on it. In February 2011, they launched a startup called Wall Street Magnate, (WSM), the “fantasy football version of investing,” as Cohen calls it. The de facto launch date for WSM was May 2013, the go-live date for its website, followed by the July 2014 release of an app. As of last count, Wall Street Magnate’s numbers are modest but growing, with more than 60,000 members and an average of 20 million hits per month on the site. Modest by their own count; they aim for millions of users.

Laurence Cohen, W’00

Given the success of fantasy anything and the ubiquity of investing, you would assume success, but the Wall Street Magnate team also has purpose. At heart, says Cohen, the team is hoping to change the way that people gain financial literacy, making it fun, easy and social. The platform is free, entirely without risk and full of the real-time excitement of the market. Members buy and sell real-world stocks from a simulated investment accounts based on actual market data. The platform accounts for both dividends and stock splits in real time, and streams the latest financial news. To further the learn-while-doing model, users can also generate and export spreadsheets that track their complete trading histories.

“There is a lot of power in the data,” Cohen says.

Power and opportunity. In an earlier interview with TechCrunch, the site’s founders related the story of one of their beta users. He was already a stockbroker but hoped to move into the buy side. He downloaded the history of 1,400 Wall Street Magnate trades and brought it with him to a job interview. He got it.

A screenshot from the mobile version of Wall Street Magnate

To us, Cohen offers up more recent anecdotal evidence of the site’s educational value: The chairman of the Department of Statistics and Operations Research at the University of North Carolina teaches his Stochastic Models in Finance course using the site, and high school teachers in Pennsylvania, Connecticut, Maryland, Florida, Texas and California are applying WSM in their classrooms.

Students are taking to it on their own, according to the founders. Why? In part, competition. Just as fantasy sports players join leagues and compete against friends and colleagues over the course of a season, WSM allows members to participate in a “club” structure, first introduced in May 2014. Hundreds of university and high school investment clubs from all over the world have taken to Wall Street Magnate since this feature went live. And as the team has simulated the experience of trading, it has also incorporated another attraction of fantasy sports—smack talk. Members can use built-in instant messaging to get under the skin of friends in their league—or collaborate with them, if it’s more a club-type setting.

Overall, one would expect an authenticity to it because Cohen’s day job is trading and has been since he graduated from Wharton.

“It’s as realistic as it can possibly be without using real money,” he adds.

Currently focused on growth and delivering the highest quality user experience, Cohen explains, WSM will look for “various potential partnership and co-marketing arrangements” as the game’s user base grows. In the meantime, both men are funding the venture and running it while still working their full-time jobs (Schlossberg is a corporate lawyer). WSM’s a second job, well worth it, given they both have dreamed of becoming entrepreneurs. And now that they are both over 30—not quite midlife crisis age but closing in—they knew it wasn’t too late, but they had to act now.

Read Related Articles