Three waves, 43 million cases, and 1.89 billion vaccine doses later, India seems to be on the road to recovering from the pandemic. From a high of 414,000 to approximately 3,000 daily cases today, the country has undergone massive changes, and so has our beloved startup ecosystem. As we return to normalcy, I thought it would be a good idea to take a stroll down memory lane to see the challenges we faced and milestones we crossed.

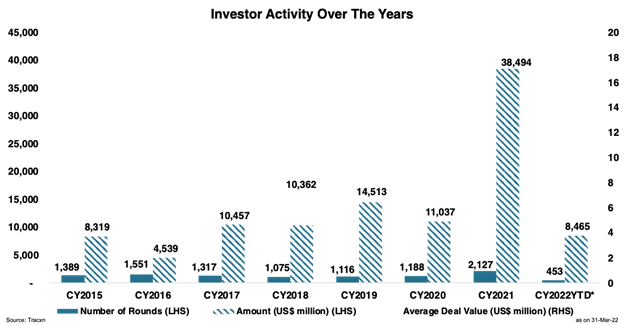

Pre-pandemic, the Indian startup ecosystem was gaining momentum, as it clocked more than $10 billion in investments in each of the preceding three years. Driven by growing consumption, attractive fiscal policies, and rising internet and mobile penetration, 2019 marked the year with the highest capital inflows into the startup ecosystem at $14 billion, and the number of unicorns created at nine. While people were aware of the large, well-funded unicorns, like Paytm, Flipkart, Zomato, Swiggy, etc., few knew what Indian startups were truly up to. For the general populace in India, VCs were comparable to banks that doled out loans to aspiring entrepreneurs in the olden days. In fact, our families often asked why we didn’t use our fancy finance degrees to go work for a big bank!

Source: Tracxn

As COVID-19 spread across the world, the country went into lockdown. Schools, colleges, malls, gyms, restaurants, and other brick-and-mortar establishments were forced to shut shop. Economic activity and investments were brought to a grinding halt. During this time, the ecosystem showed its resilience as the government came forth with measures, including a loan program offered to startups and SMEs via SIDBI while the VC community pooled in some funds to support their holdings. In fact, the April-June quarter of 2020 witnessed the lowest investment activity since 2016, with only $1.7 billion invested across 247 deals. Uncertain times led to complex valuation exercises, with a greater number of variables (such as cost of capital, growth rates and multiples) and scenarios needed to be accounted for. These numbers were supported by on-ground reports of businesses running out of cash, salary cuts, and job losses.

Source: Tracxn

While the first quarter of the pandemic was spent in uncertainty, India, Indians, and the startup ecosystem showed their grit, resilience, and adaptability. Working from home, learning from home, and shopping from home became the new normal. India had finally gone online. We saw the emergence of new online businesses as entrepreneurs sought to capitalize on greenfield opportunities in education, health care, and e-commerce. Investors and consumers, too, were ready to support these bravehearts in their new ventures, as everyone adjusted to the new normal. Startups proliferated even more, and India realized that it could not do without online grocery delivery, online shopping, tele-consultations, and the like. The same family members who had once asked us to be bank managers were curious about Nykaa, BigBasket, Swiggy, and Cult.fit.

As lockdown norms eased during the end of the first wave, we saw a strong bounce back in economic and investment activity. While a 24 percent drop in capital inflows would spell doom and gloom under normal conditions, we believe that given the extenuating circumstances, the ecosystem performed reasonably well during 2020.

Source: Tracxn

Given the new reality and the onset of the second wave, which was worse than the first, 2021 was expected to be a tepid year for India. Never had anyone been so wrong. The year started off in true boisterous fashion, with almost $7 billion invested into startups in the first quarter alone. Given that Indians were forced to sit at home, the only interaction they had with the outside world was through the digital medium. New age, digital-first businesses were at the right place, at the right time. They pushed on the pedal to supercharge their growth, and as a result, the first three months saw the rise of 10 new unicorns. Every quarter set new records in capital inflows, largest seed rounds, and valuations. While the country braced for new restrictions and lockdowns, technology-enabled businesses experienced adoption at levels never seen before. This led to 2021 being the best year ever for the startup ecosystem. $38 billion was invested across 2,100 deals, which also led to the birth of 44 new unicorns, more than all previous years combined.

2021 also marked a major milestone. Through IPOs, buybacks, mergers, and acquisitions, investors, founders, and employees were given exits to the tune of $43 billion. We saw startups such as Nykaa, Zomato, Paytm, PolicyBazaar, and CarTrade open themselves to the public and list on exchanges. The interesting thing about these exits is that a solid chunk of the liquidity they provided has reached the perennial ecosystem participants, and this has kickstarted a cycle where these participants have started investing capital back into the ecosystem, either as angel investors or limited partners in venture capital funds.

The pandemic proved fatal to many aspects of our lives. Our favorite restaurants shut down, we lost dear ones, people lost their livelihoods, and so forth. On the other hand, we spent more time with our families than ever before, people across the social and economic strata were exposed to the wonders of technology, and entrepreneurs became celebrities.

As the public markets push down technology company valuations on the back of expected rate hikes and geopolitical tensions, we remain optimistic about the future of the startup ecosystem. Technology has impacted all walks of life, and funds that back technology-enabled new economy businesses are at the forefront of this transformation. They are making the most of these changes as they identify them ahead of time. A whole new world has opened up with blockchain as the fulcrum and has given rise to the emergence of Web3, cryptocurrencies, NFTs, DeFi, DAO, and the like. Other newer technologies like AR/VR and AI have spawned a new metaverse and we have to fathom and exist in these alternate digital universes. Investors should gear themselves up to make the most of these new technologies.

Rajesh Sehgal WAM15 is managing partner of Equanimity Ventures, a sector-agnostic venture capital firm based out of Mumbai, India, investing in early-stage, technology-enabled businesses.