It feels like ancient history now, but it is only about three months ago that China and the United States signed a “Phase One” trade deal and declared a cease fire to their 18-month trade war. Back then, this conflict was the biggest threat to the global economy.

Now, the new coronavirus is changing and challenging literally everything. The China-U.S. relationship — arguably the most important bilateral relationship in history between the world’s biggest and most powerful countries — is no exception.

Here are my predictions about those changes, from right now to how the world will look when we are on the other side of the crisis.

1. The Very Short Term (Now Through the Second Half of 2020)

Name calling, but no new crises

Political leaders are under impossible pressures. Why didn’t they see the crisis coming? Why didn’t they act sooner? How are they going to mitigate its economic damage? It is no surprise that some political leaders in China and the U.S. have engaged in mudslinging over the origins of the coronavirus. This is very regrettable since it cannot help — and only distracts from — the gargantuan challenge of responding to the combination of a once-in-a-century public health crisis coupled with the biggest hit to the global economy since the Great Depression.

But this mudslinging has not risen to the level of official foreign policy. The only exception is Donald Trump’s very public questioning of the World Health Organization’s activities in and support for China during the early stages of the crisis. The president then balanced his criticism of WHO with his respect for Xi Jinping.

Keeping a lid on the name calling — despite the domestic political incentives to escalate — is a good thing. And I expect it to continue, for one obvious reason: Neither China nor the U.S. can risk any further destabilization of their economies, which would surely be the consequence of any new diplomatic crisis between the two countries.

I suspect “no new crises” will extend through the remainder of 2020, above all because both China and the U.S. will do whatever they can to try to engineer something like a V-shaped recovery in the final quarter of the year.

2. Through the Phase One Timetable to December 31, 2021

A much-reduced trade deficit, without China’s meeting its Phase One commitments

The end of 2021 is the deadline for the most important provision of the Phase One trade deal: China’s commitment to buy $200 billion additional goods and services focused on agriculture, energy, and manufacturing. That is the next natural milepost in the evolution of China-U.S. relations.

The plain truth is that it will be essentially impossible for China to meet this commitment. It was always going to be extremely hard for the Chinese government to guarantee what amounted to a trebling of Chinese imports from the U.S. in two years. Now, the reality of an unprecedented economic slowdown in China (the IMF is now estimating that the Chinese economy will grow by 1.2% in 2020, by far the worst performance since China’s “opening up” in 1978) makes it almost fantastical to believe that Chinese domestic demand could absorb so much additional American production.

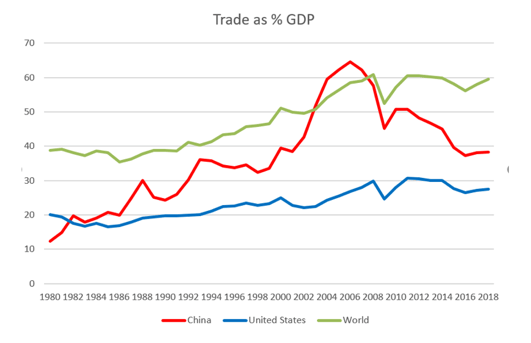

(Source: World Bank World Development Indicators)

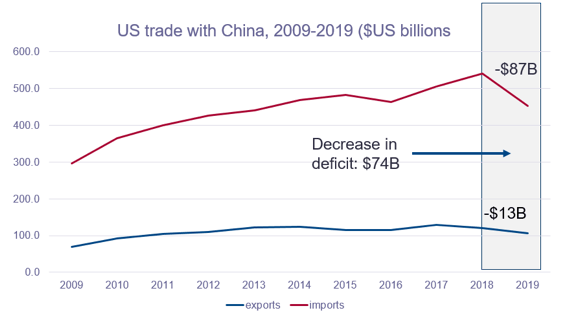

But while it seems fanciful to expect China to meet its Phase One commitments, there is much better news on the Trump administration’s ultimate reason for the trade war — the mushrooming of the trade deficit the U.S. runs with China over the past two decades, topping $400 billion in 2018.

A stunning thing happened while all our attention was focused on the trade war: For the first time in 20 years, the trade deficit declined in 2019, by $74 billion. Note, however, that this was the product of the fact that China sold $87 billion less in goods and services into America in 2019 compared to 2018. Over the same 12 months, American exports to China (Trump’s hobbyhorse) actually declined, but by much less ($13 billion). This trend of much lower Chinese exports to the U.S. is bound to get even more pronounced with plummeting U.S. demand for the remainder of 2020.

If the U.S. government cares above all about the trade balance with China, the next two years are likely to be full of good news. But if the U.S. remains fixated on American exports to China, the road will be much rockier.

I hope cool heads prevail, because the U.S. will have every reason to understand why China won’t be able to meet its core Phase One commitment. This could open the possibility of new negotiations over a Phase Two deal with China, rebased post-COVID-19, and from a better position from the U.S. perspective (i.e. a smaller trade deficit).

3. 2022 and Beyond

A new “new normal”: decoupling, deglobalization, and geopolitical instability

I am not sure, however, that the broader climate of China-U.S. relations will accommodate something like a Phase Two trade deal. True, the China-U.S. trade imbalance will have narrowed greatly, something most will cheer. But I suspect this good news will be overwhelmed by a post-COVID-19 new normal in which the watch words will be “decoupling” and “deglobalization.”

The decoupling of the global supply chains entwining the American and Chinese economies has become an increasing priority for both countries in the past year, especially where there are national security considerations (e.g. high-tech firms like Huawei). Now, with the coronavirus, everybody is already talking about the imperative to “shorten” and “strengthen” the health-care supply chain. Far from slowing down decoupling, the virus will only accentuate efforts to disentangle the American and Chinese economies from each other.

(Source: U.S. Census Bureau)

The same story holds true for globalization more generally. The above graph makes two things clear. First, the rise of China as a trading nation was perhaps the greatest driver for the unprecedented globalization we witnessed in the 30 years from 1980 to the financial crisis. Second, 2008 was already standing out as “peak globalization,” with a dramatic decrease in China’s reliance on trade in the decade since then and a stagnation of both global and American trade at the same time.

Decoupling between China and the U.S. is looming now as the driver of even further deglobalization in the post-COVID-19 world. As my colleague Mohamed El-Erian put it well in a lecture to Penn students recently, the globalization era was all about “efficiency.” We are now entering a period that will be likely dominated by “resiliency,” and resilience requires sacrificing cost, quality, and choice in the name of security of supply. That means deglobalization.

I fear the ultimate price of deglobalizing will be measured in terms of increased geopolitical instability and the greater chance of conflict between China and the U.S. above all. It may feel a long way from the immediacy of the COVID-19 crisis. But it is unfortunately all too easy to picture the path that might lead us there. We can only hope that our political leaders in both countries are capable of managing down their conflicts in the name of peace and prosperity.

Geoffrey Garrett is Dean, Reliance Professor of Management and Private Enterprise, and Professor of Management at the Wharton School of the University of Pennsylvania. This post was originally published on LinkedIn, where he was named an “influencer” for his insights in the business world. View the original post here. Follow Geoff on Twitter.

For more on what’s at stake for the global economy in the wake of COVID-19, listen to Dean Garrett’s interview with Morning Brew’s “Business Casual” podcast.