I’ve noticed that many market participants point to the historical performance of high dividend yield investing as a way to outperform the benchmarks. Well, it turns out that this is true but misleading.

My colleague Jack R. Vogel and I published a paper on the subject of high-yield strategies a few years ago. A copy of the paper can be found here.

The bottom line is as follows:

“High dividend yield stocks do not reliably earn above-average risk-adjusted returns. More complete measures of shareholder yield, which account for net share repurchases, perform better.”

So sophisticated yield strategies work better than plain vanilla yield strategies, but dividend yield strategies are not great, at least after adjusting for market factors such as beta, value and size exposures.

What we didn’t emphasize in this paper, but probably should have emphasized in retrospect, is that all yield-based strategies are essentially noisy proxies for “value” investing strategies—and that is why they outperform. High dividend yield stocks are good expected bets if they are cheap; they aren’t good expected bets if they are expensive. Historically, high-yield stocks have been “cheap stocks,” but today, high-yield stocks are actually expensive. And if history is any guide, buying expensive stocks rarely ends up with a favorable outcome.

But why are high dividend yield stocks so expensive?

Consider the typical day in the marketplace:

Investors screaming, “I want yield!!!”

And asset managers launching product to fulfill demand:

“________ Dividend Yield Fund just launched!”

Wall Street knows how to create products to fulfill the pavlovian dog response to the word “yield.” In fact, they are a little too good at fulfilling investor demands for yield (e.g., see my piece on how mutual funds manipulate yield numbers to drive client demand).

High Dividend Yield Stock Valuations

We first look at 2 measures of cheapness: EBIT/TEV and P/E. Ideally, we want to see that the current crop of the top 50 dividend yielding S&P 500 stocks are also cheap.

Turns out they are not.

They are actually quite a bit more expensive than the median S&P 500 stock. Thus, high yield no longer equals cheap.

First, let’s look at valuations based on EBIT/TEV (higher is cheaper; lower is more expensive). The green line is the S&P 500 median EBIT/TEV; the red line is the median EBIT/TEV for the top 50 yield names; and the bars highlight the distribution of EBIT/TEV for the high-yield portfolio.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

You’ll notice that high-yield stocks are generally more expensive than the market (green line is above the red line). There are certainly some cheap high-yield stocks, but on average, the bucket of 50 names isn’t cheap.

Next, valuations based on P/E (higher is more expensive; lower is cheaper). Similar story: high-yield stocks are more expensive than the market (the red line is above the green line).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

In summary, the top 50 high dividend yield names are expensive relative to the market on EBIT/TEV or P/E metrics. That’s not good.

High Dividend Yield Companies Still Higher Quality?

You might say, “Well, yeah, they are expensive, but these high-yield companies are exceptional companies so they deserve a premium.”

Nice story … but there is little evidence to support this notion!

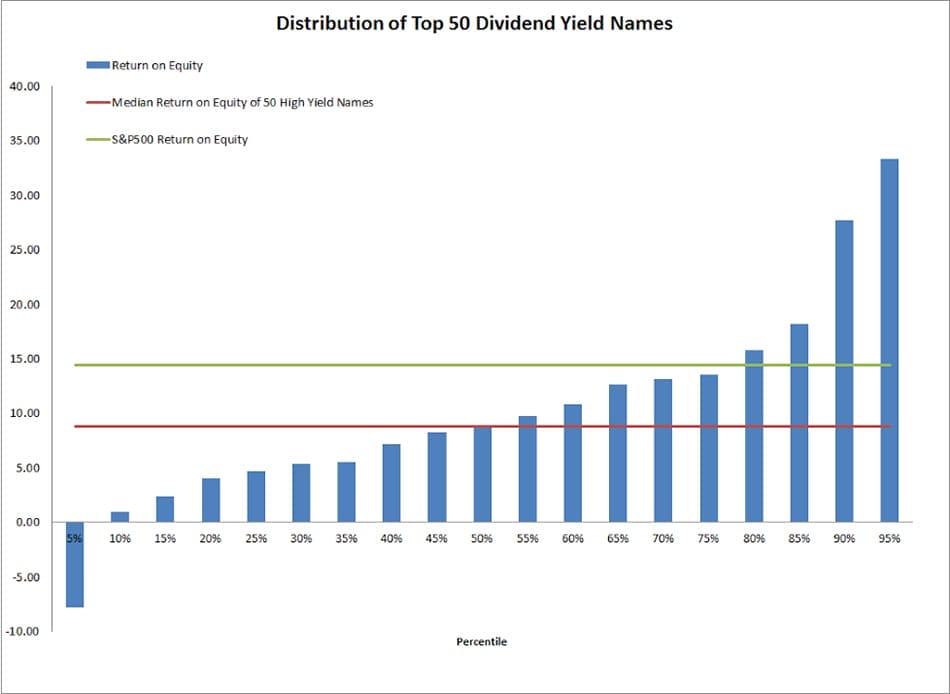

First, a look at return on equity. High-yield stocks have much lower ROE than the typical S&P 500 firm.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

But how about return on assets? A similar but muted finding—High-yield stocks have lower ROA than the typical S&P 500 stock.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

In summary, high dividend yield stocks don’t seem to be much higher quality than the market.

Also, don’t forget that dividends are taxable. To the extent that your total return consists of a larger amount deriving from taxable yields you are losing tax deferral benefits.

Still Excited to Buy High-Priced, Low-Quality Stocks?

If you are venturing into high dividend yield funds in the hopes you will earn some extra income, you might be in for a nasty surprise. As Ben Graham discussed in the past, intelligent investing is about buying stocks with a margin of safety … he didn’t suggest that investors focus on high-yield stocks.

Let’s repeat: value investing is about buying stocks with a margin of safety.

In other words, focus on cheap stocks where expectations are lowest and fundamentals are sound. Put differently, buy value investing funds that focus on cheap, high-quality firms—not dividend yield funds that buy expensive, relatively low-quality firms.

Unfortunately, high-yield strategies today are not following Ben Graham’s advice. Time will only tell if Ben Graham’s investment advice rings as true in the next 100 years as it has rung true over the past 100 years.

Good luck!

Editor’s note: The original version of this article first appeared on AlphaArchitect.com on March 24, 2015.

The information contained herein is only as current as of the date indicated, and may be superseded by subsequent market events or for other reasons. The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees.

This information is not intended to, and does not relate specifically to any investment strategy or product that Alpha Architect offers. It is being provided merely to provide a framework to assist in the implementation of an investor’s own analysis and an investor’s own view on the topic discussed herein. Past performance is not a guarantee of future results.

The results in the above analyses are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.