If you can’t beat them, buy them.

That was the mantra of leading technology companies in the tech boom days of the 1990s, when innovation was moving at such a frantic forward pace that even industry leaders like Cisco couldn’t keep up with the latest advances. Faced with the prospect of falling behind the competition, top companies began buying up smaller firms — and their promising, if untested, technologies — to stay on the cutting edge.

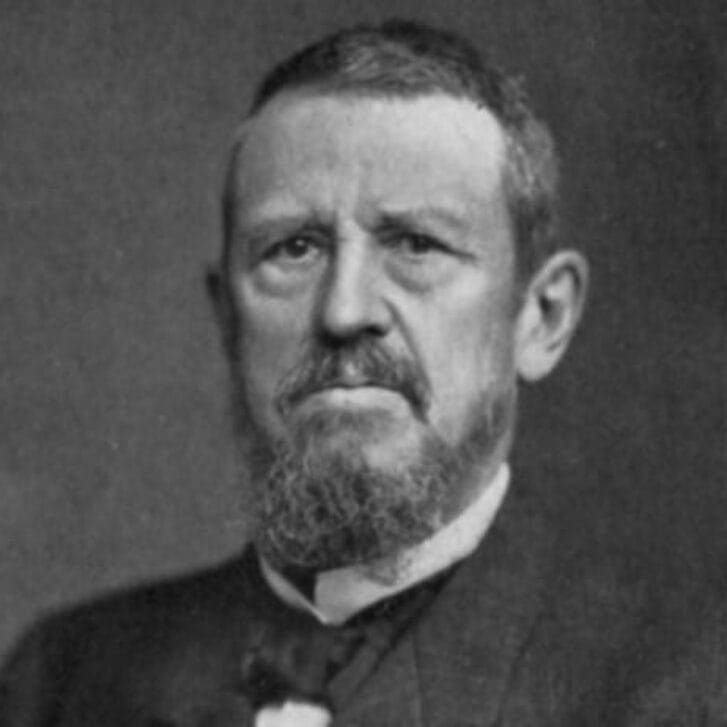

For a while, the strategy seemed to be a good one, or at the very least, a popular one. Companies spent $3.5 trillion on acquisitions between 1992 and 2000, making those eight years the most active M&A period in history. Then the tech bubble burst and M&A activity came to a screeching halt. Acquisition leader Cisco, which purchased 70 companies between 1992 and 2000, bought just two in 2001. It became evident that while some purchases helped acquirers reap benefits, many failed to create the intended value. Saikat Chaudhuri, W’97, E’97, a Wharton assistant professor of management, believes he knows why. His research is especially timely given the recent growth in M&A activity in the tech sector and other innovation-driven industries.

Companies who once were acquisition-crazy, says Chaudhuri, soon realized that while buying technologies was easy, making them pay off was not. Indeed, researchers looking at mergers and acquisitions in tech fields have acknowledged for years that the challenges of successful acquisitions are significant, as are the challenges of post-acquisition integration. Yet they have also suggested that the strategy of buying young companies with early-stage technologies in emerging markets is a good way of hedging against the possibility of missing out on major technological advances. Further, they have generally agreed that once a purchasing company finds an integration strategy that works well, this strategy can be applied to almost any acquisition.

But after spending two years studying the M&A activity of three top communications equipment and software firms, Chaudhuri says those assumptions are wrong. “What I did was reframe how we look at acquisitions,” he notes.

Four Major Challenges

By examining the challenges of the innovation-through-acquisition strategy in detail, Chaudhuri’s work offers suggestions to managers on what kinds of target companies are worth pursuing and what strategies should be used to integrate those companies once they have been bought. Chaudhuri, an alumnus of Penn’s Jerome Fisher Program for Management and Technology, continued his engineering education at Stanford and his management education at Harvard before returning to Wharton to pursue his research interests in technological innovation, mergers and acquisitions, and organizational adaption.

Innovation acquisitions, according to Chaudhuri, present four major challenges at the product, organization, and market levels: integrative complexity due to technological incompatibilities, integrative complexity due to the “maturity” of a target company, the unpredictability of a product’s performance trajectory (“technical uncertainty”) and the unpredictability of that product’s market (“market uncertainty”). Different target companies present different degrees of these variables, he says, and so each acquisition presents its own benefits and drawbacks. For instance, by buying a company whose products are based on a different technological platform, a purchasing company can gain new technological functionalities and capabilities. But such a deal would also pose a significant integration challenge because the platform disparity would have to be resolved. Chaudhuri points to Microsoft’s purchase of Hotmail as an example. At the time of the deal, Microsoft was based on Windows, Hotmail on UNIX. “It took a few years to integrate those functionalities seamlessly,” he says.

Similarly, acquiring an older, more mature firm can offer stocks of proven competencies as well as optimized processes, but poses greater integration challenges due to entrenched work routines and cultures and more cumbersome task reallocations. Microsoft’s acquisition of Great Plains to link front-end applications with enterprise resource planning (ERP) applications is a case in point, Chaudhuri notes. “The idea behind the deal is to have seamless integration between the back-end ERP applications — like manufacturing planning, supply chain management, HR management and financial accounting — and front-end Windows and Office applications. But since Great Plains’ relationship-based consulting approach, supporting processes and IT systems are very different from Microsoft’s infrastructure (which is geared towards selling packaged software), these differences are naturally taking time to be reconciled.”

The important takeaway from these deals is not the difficulty Microsoft had in overcoming the integration complexity, says Chaudhuri, but rather the fact that the problems could be, in fact, overcome. Through detailed planning and piecemeal execution, Microsoft has been working through the product and organizational differences.

While “complexity” challenges in innovation acquisitions are real, visible and significant, it is the “uncertainty” variables — the unpredictability of markets and product success — that present the larger challenge for purchasing firms. According to Chaudhuri’s research, technical incompatibilities between two merging companies slowed the time it takes to get a product on the market, but did not hurt financial performance; target maturity was positively correlated with performance. Technical and market uncertainty, however, were shown to both slow the time to market and result in diminished financial returns.

Impact of Complexity and Uncertainty

In one of two papers that resulted from his research project — “The Multilevel Impact of Complexity and Uncertainty on the Performance of Innovation-Motivated Acquisitions” — Chaudhuri says that while “companies have been able to recognize, and have learned how to manage and even exploit, integrative complexity,” they have been unable “to cope with product and environmental uncertainty in these innovation acquisitions…. The findings suggest that companies tend to give attention to those innovation acquisitions which are complex, but underestimate, or are unsure how to handle, those deals surrounded by uncertainty. Existing acquisition processes appear to be geared towards managing complexity rather than uncertainty.”

When a company buys a target with unfinished products, it brings the possibility of securing promising technologies and the ability to influence their progress, he says. “But there’s also the risk that the technologies just won’t develop as expected, and less knowledge about the technology means that less focused planning can be done upfront in resource allocation and integration.” He cites the example of Nortel’s purchase of the startup Xros, which had pioneered an early prototype of a photonic switch that the acquirer hoped would form the backbone of an all-optical network. “Unfortunately, the micro-mirror system never became stable enough to turn into a fully functional product, even after much engineering effort,” he says.

Chaudhuri observes that “with markets, it’s a similar situation. If you get there early, you might dominate a new area. But it also might be a premature commitment to a market that may not evolve.” He again uses Nortel as an example. “Nortel acquired Qtera, a startup developing an ultra-longhaul optical transport product, intending to sell equipment to the many telecom carriers who were furiously building networks globally. Soon after, however, the telecom service providers realized that the projected growth in demand for bandwidth was grossly optimistic, and stopped spending on next-generation, long-haul transport devices, upgrading their existing platforms instead.”

Flawed Strategy

Among his more important findings is Chaudhuri’s contention that “buying companies with early-stage products and entering uncertain markets had substantially adverse effects.” That’s significant, because it flies in the face of the notion that buying these “uncertain” products and companies is a good strategy simply because it might pay off down the road. “Contrary to what everyone expected — that doing things early is good — the uncertainty was actually so high that it had tremendously negative consequences for a firm,” he says, “including fairly established and successful firms.” Even companies that had been making acquisitions for years and could easily handle older firms and those with different technological platforms — both of which increase integrative complexity — could not effectively do anything to account for uncertainty.

That’s because “complexity is intrinsically predictable,” Chaudhuri notes. “If one places sufficient resources and project management strategies in the right places, it’s possible to manage the complexity. You can learn how to do it. But uncertainty, by its very nature, requires constant adjustment. This type of flexibility is tough to achieve, especially in the middle of integration activity.”

So the question becomes: Is the entire innovation-through-acquisition strategy flawed? Should companies abandon it entirely?

No, says Chaudhuri. The strategy itself can be a valuable one, if applied correctly. For managers, that means first, targeting and buying only the right companies, and second, using smart strategy to integrate them into their company’s structure. As he writes: “Fundamentally, the challenges in conducting acquisitions surrounded by high levels of product and environmental uncertainty lie in selecting the right technologies and markets, and adjusting to new information as external conditions evolve. The managerial implications are that technical and organizational complexity can be planned for and thereby handled effectively, while it may perhaps be safer to delay acquisitions” to a time when the uncertainty of technologies and markets has lessened.

In other words, purchasing firms can help themselves by only buying those companies that bring along limited uncertainty. Even highly complex deals with low uncertainty may be attractive, Chaudhuri says. “One of the options, and one of the immediate implications of the research, is to delay acquisitions until uncertainty is reduced. The disadvantage, of course, is that [the longer a company waits], other players will likely become interested as well, and the price will go up. There’s a very clear tradeoff there.”

Cisco, once the leader in innovation-through-acquisition, appears to be doing just that. Chaudhuri says the company has adopted a wait-and-see approach to technology acquisitions. “My advice would be to wait as long as possible for uncertainty to be reduced, but to go ahead and engage in these more complex acquisitions.”

After all, there are still valuable targets to be had. And companies should not shy away from pursuing those that fit the profile, Chaudhuri suggests, so long as managers are prepared to craft an integration strategy specific to the deal.

Always a Tradeoff

With few exceptions, companies and researchers have assumed that one integration strategy can be employed for any number of deals, and have tried to find “optimal models to follow,” particularly during the tech boom. But Chaudhuri says his research provides convincing evidence that a rethink is necessary. Instead, companies must be flexible when bringing a new company under their wings. Different acquisitions will demand different approaches. Sometimes, it may be best to blend operations of the two companies immediately; other times, keeping them separate may be preferable.

As Chaudhuri notes in the second paper from his research project, “Managing Innovation-Driven Acquisitions: Contingent Effects of Integration Strategies on Performance,” the findings “suggest that each of the challenges inherent in innovation-targeted acquisitions can be managed with aligned integration strategies, where levels of organizational integration, process adoption, and product knowledge sharing are aligned with the nature of the specific complexity or uncertainty variable.”

For instance, if a large firm buys a small company about to complete development of an exciting new product, it may not be in the best interest of the purchasing company to rush the integration process. Rather, the better move may be to allow the smaller company to continue operations as usual, until the new product is ready. In fact, Chaudhuri found that in such situations where a purchased company brings to its new parent a product with high levels of technical uncertainty, the buyer sees improved financial performance by employing a strategy of low organizational integration, low levels of process adoption from the target and delayed product knowledge sharing.

“In that case, since the technologies are still uncertain and the group is still working on it, lower integration allows the group to keep working … and gives it the flexibility it needs to adjust to evolving requirements,” Chaudhuri says. “Your intent here is just to get [team members] to build the product. They don’t need any distractions, so joint product work and knowledge sharing are also not beneficial.” At the same time, he says, since the larger company likely has a set of processes that have been proven effective in bringing new products to market, simultaneously giving the target team such methodologies and tools is helpful in yielding a positive outcome.

The trick is to find the right integration strategy for the right deal, by understanding the “explicit tradeoffs involved.” Chaudhuri’s research identifies these tradeoffs. “A high degree of integration enables scale and coordination efficiency, but can potentially disrupt routines underlying capabilities and lower flexibility. Adoption of target processes by the acquirer preserves codified knowledge, but sacrifices scale and replicability. Knowledge sharing expands knowledge bases, but distracts resources from operations,” Chaudhuri explains.

The bottom line? Making an acquisition work is just as difficult as finding the right company to buy in the first place. “It’s necessary to figure out what works and under what conditions,” Chaudhuri says. “You have to look at what the inherent challenges are to determine whether to buy the firm, and then design the appropriate strategy to manage it.”