Celebrated as a Christmas classic, the 1946 film It’s a Wonderful Life also offers a sobering reminder about bank runs: They’re an unfortunately familiar story throughout history. And as illustrated by big bank failures this year, starting with Silicon Valley Bank in March, we surely haven’t seen the last of them.

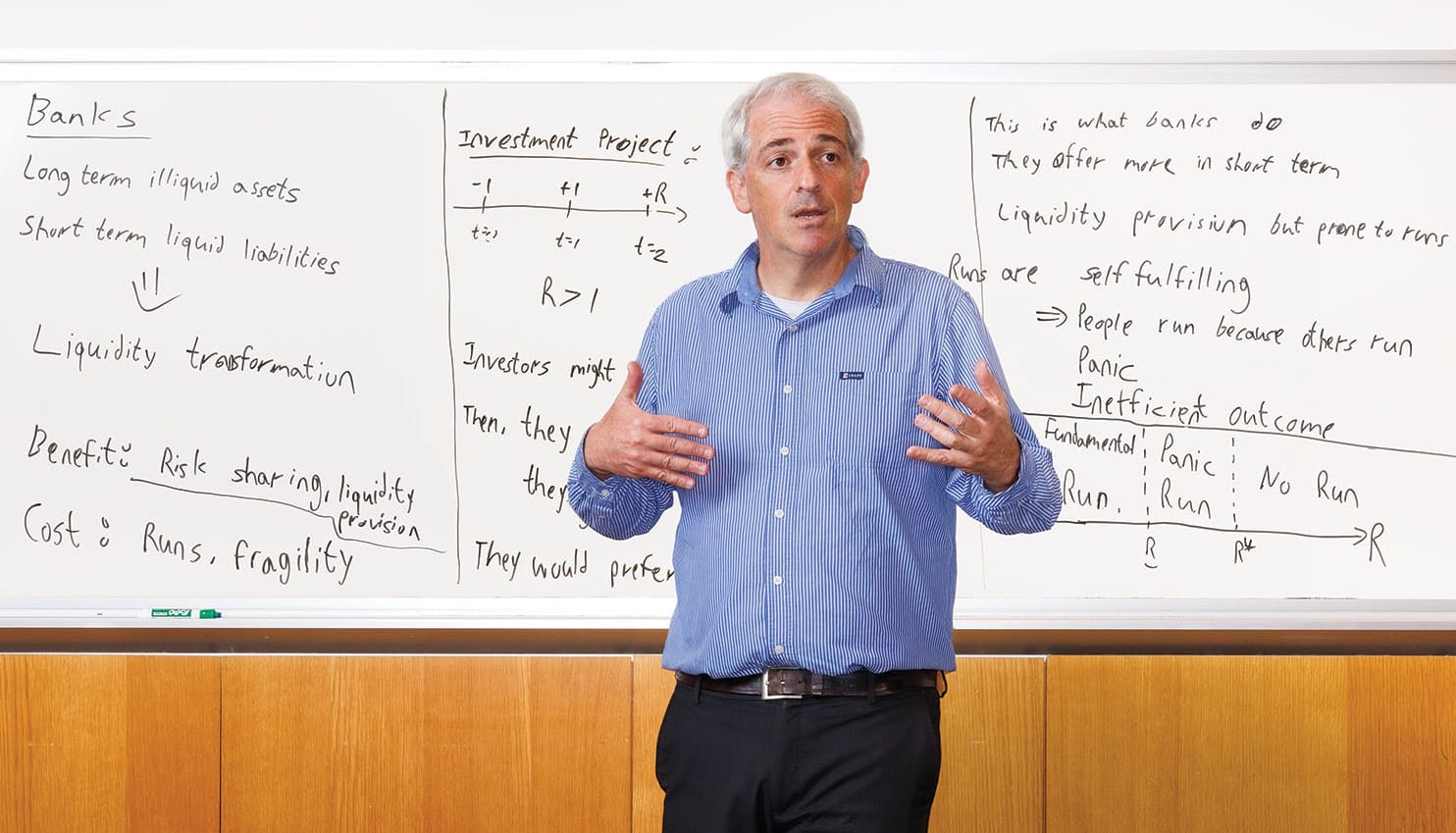

“Silicon Valley Bank brought the subject back to the headlines here in the U.S., reminding people of the fragility of banks,” says Itay Goldstein, chairperson of Wharton’s finance department and the Joel S. Ehrenkranz Family Professor. The SVB collapse was followed by bank runs at institutions such as Signature Bank in New York and First Republic Bank in San Francisco. Goldstein, who analyzes bank runs and their underlying causes with students in his PhD course Corporate Finance and Financial Institutions, also tackles the subject in Executive Education programs such as Advanced Corporate Finance.

While modern-day runs differ in some ways from those of the past — for one, customers once had no choice but to physically go to the bank to withdraw funds — key features remain the same. Namely, banks put much of the money that customers deposit into investments such as loans and bonds, which generate returns for the bank, and keep some cash on hand to cover withdrawals. They count on only a fraction of depositors wanting their money back at any given time. “They provide short-term liquid liabilities at the same time that they have long-term illiquid assets,” says Goldstein. Those fundamentals get banks into trouble when customers perceive that the banks are underperforming and may not have enough cash to return money at will. Typically, if those worries turn into panic, customers try to withdraw their money en masse.

While the U.S. government has instituted guardrails against bank runs — including insurance for deposits of up to $250,000 — SVB’s collapse, in particular, has highlighted unique systemic vulnerabilities. SVB’s customers were largely startups, and 94 percent of the bank’s deposits were over the $250,000 insurance limit. Furthermore, because customers were in the same industry and talking to each other, panic spread rapidly. “There wasn’t much diversification in the depositor base,” says Goldstein. “People thought that was a risk before, but not as vividly as now.” SVB also invested much of its money into long-term bonds, so it didn’t have cash on hand when customers began to worry. As for what the firm’s failure could mean for the future: “Usually, regulators learn from what happened and put some brakes in place,” says Goldstein. “But inevitably, risks pop up.”

Published as “At the Whiteboard With Itay Goldstein” in the Fall/Winter 2023 issue of Wharton Magazine.