The truth is out there, and Justin Wolfers believes economics is the means to find it.

Justin Wolfers pauses when asked about his latest projects: “Right now,” he says, “I’m doing a lot of work on happiness.”

Which sounds strange because Wolfers, a newly tenured associate professor of business and public policy, is a noted economist, not a sociologist or psychologist, so why would he care about how happy people are?

Because economics isn’t just about numbers, Wolfers says. It’s about people.

“Numbers are just aggregations of stories,” the 35-year-old Australia native says. “If I poll 1,000 people and ask them about their lives and find 73 percent are happy, that’s really a whole bunch of stories but I found a compact way of representing them. As an empirical economist, I’m struck at how useful stories are.”

Wolfers is part of the new breed of economists, using economic principles to analyze and assess anything from crime data to marriage statistics, mining the information for everything from interesting factoids to sound public policy suggestions.

An economic Renaissance man, his work has been noted everywhere from scholarly journals to Sports Illustrated. He’ll make the case that the death penalty doesn’t deter murder as easily as he’ll describe a pattern of point shaving in college basketball. The New York Times last year listed him as one of the country’s top young economists doing research on real-world problems, while ESPN Magazine named him one of nine behind-the-scenes sports power brokers.

“Economics is merely a lens through which we can view the world around us,” Wolfers says. “Some of my work interfaces with psychology, some political science, some criminology, some sociology. We’re social scientists trying to understand the world.”

Some refer to this as “freakonomics,” so-called after the 2005 book of the same name by economist Steven Levitt and journalist Stephen J. Dubner. (In fact, Wolfers contributes to the blog of the same name that’s part of the New York Times’ website.) The impolite term is “economic imperialism.”

Wolfers rejects the latter label, noting, “I have a profound faith that we can provide some useful insight — and the people who hate economic imperialists should be happy I said, ‘some.’”

“My job,” Wolfers says simply, “is to make the world a better place.”

Take the work he and fellow Wharton professor Betsey Stevenson are doing on happiness, which he believes will change how countries shape economic policies.

For 30 years, many people have subscribed to what is known as the Easterlin paradox. Economist Richard Easterlin’s research showed that a country’s increased economic growth did not mean its populace would be happier. He also concluded that while rich people in a country are generally happier than poor people, rich countries are not happier than poor ones.

Stevenson and Wolfers reanalyzed that data as well as more recent surveys and drew different conclusions. While they agree that rich people are happier than poor, they also find that rich countries are happier than poor ones and more riches do equal more happiness.

“The implication was not the old view that economic growth is not something we should care about. It was an idea very influential in Europe, that we should stop caring about politics that concern this economic group,” Wolfers says. “This new view leads to completely opposite implications.”

Numbers, Wolfers shows, can reveal feelings and emotions. When he and two co-authors wanted to know how stock and bond markets were affected by the election of a Republican versus the election of a Democrat using prediction market-based analysis, they focused on what Wolfers called “the random Kerry presidency,” or the four hours on Election Day 2004 when John Kerry was predicted to win the presidency.

“Around 3 p.m. the polls got leaked and everyone thought Kerry had won in a landslide,” Wolfers says. “The question is how did the financial markets behave when they really were acting as if John Kerry was president.”

Looking at market fluctuations in the period immediately before and after the “Kerry presidency,” the study found that markets anticipated lower equity prices, interest rates, and oil prices under a Democratic president. The study captured traders’ expectations of partisan effects rather than the actual outcomes. (Prediction-market-based analyses of all presidential elections since 1880 revealed a similar partisan pattern.)

“Oftentimes, when you have an experiment, people say, ‘Will this work in the real world?’ and you’re saying, ‘A four-hour Kerry presidency might be different from a four-year presidency,’” Wolfers says. “But the emotions and how it changes people’s view of economic conditions is exactly what we’re trying to measure.”

Even seemingly frivolous studies have many layers, like the 2007 study that found racial bias among referees in the National Basketball Association. After analyzing more than a decade’s worth of foul calls, Wolfers and co-author Joseph Price concluded that players score more points and earn fewer fouls during games in which the majority of the refereeing crew is of their same race.

The study drew national media attention. The NBA issued a stern denial, Charles Barkley called the authors “jackasses,” and Wolfers notes that it marked “the first time I’ve ever had a paper criticized by Kobe Bryant.”

Yet while Wolfers says that was all good and fun — It was odd, he said, to get into a cab the week after the project was released and have the driver ask, “Did you hear about that crazy Penn study?” — the point of the work was not to determine “if NBA referees are good guys or bad guys.” It was not just to have fun. It was an economist using economics to study social phenomena.

“The criticism we hear is that our job is to prevent poverty and stop unemployment and create economic growth and more fair and just societies. Does a study of NBA refs make the world a better place? On its face, no. I should really be off trying to figure out why Chad is so poor,” Wolfers says.

“But that paper actually and truly did start, within the basketball community, a national discussion about race… If we can get more people talking about how race manifests itself in organizations and get them to think differently about the machinations of discrimination and of what they have to look out for, then that’s socially useful.”

The Economics of Social Issues

Wolfers credits Gary Becker, whom he calls “one of my great intellectual heroes,” as the economist who took the science “beyond the supply and demand for apples and oranges.” In the 1950s, Becker was seen as somewhat of a radical as he applied economics to social issues, including racial discrimination, crime, and family dynamics.

That had all changed by the 1990s, when Becker was awarded a Nobel Prize for Economics and Wolfers was working on his undergraduate degree in economics at the University of Sydney, Australia. Wolfers considers himself among the first generation of economists to develop during a time when Becker’s ideas were considered mainstream.

“We just sort of grew up with that being how you think about the world,” he says.

From Sydney, Wolfers moved to Cambridge, MA, where he settled at Harvard to work on his master’s and doctoral degrees in economics. Even while having beers in a bar during graduate school, he and his friends found themselves putting their “nerdy theorems” to work, he says. They’d notice single men and single women sizing each other up and saw “a matching function.”

“What you see in a bar is not that different from what you see in the labor market,” Wolfers says. “In the labor market you have jobs and you have workers and they both would like to meet each other. All the workers are looking for all the best jobs. And when we go on the first interview in the labor market, we wear a tie and when we got on a first date in the marriage market, we peacock a little.”

At Harvard, Wolfers peacocked enough to meet Stevenson.The pair have been a couple for 10 years, share a Center City home and two cats, and are frequent collaborators, working together on the happiness study and other projects involving families, prompting Wolfers to note that it’s “one of those weird things when you study marriage and divorce and you end up being neither.”

And if he truly does see the world through an economic lens, perhaps his later observation that, in terms of taxes, “the closer your incomes are, the bigger the penalty for getting married,” also plays a role in their relationship. Indeed, Wolfers notes that while he does make decisions by weighing costs and benefits, he believes many people do so but just use different terminology.

“It’s either tremendously clinical and almost non-human or it’s obvious. I think it’s actually obvious,” he says.

While he was speaking, one ofthecouple’scats,Ivan, leaptfrom a nearby table onto the back of the couch and demanded attention.

“Ivan’s a little economist, too,” Wolfers says. “He was thinking, ‘Should I be bothered jumping on the couch? Pro: I might get lots of pets. Con: It’s a pain in the ass.’”

Ivan chose to be petted, a decision he did not seem to regret.

The Gambler

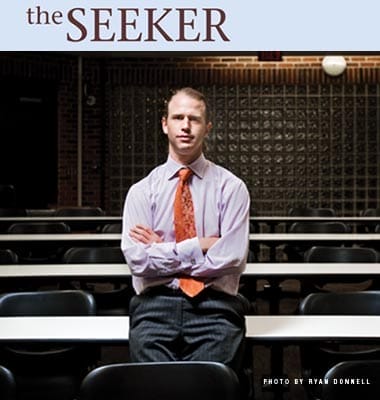

At first glance, Wolfers seems more surfer than scholar. He looks younger than his years, with shoulder-length blond hair pulled back into a ponytail, tanned skin and a wide, crooked smile. He goes for drinks with his students, publishes his home address and cell phone number on his web page. Wolfers is enthusiastic, friendly, his voice cracking when he gets excited. He uses words like “wicked” as adverbs, like when he says Philadelphia is “wicked cheap” compared to San Francisco’s Bay Area, where he lived when he taught at Stanford University. If his accent didn’t automatically peg him as an Aussie, his use of phrases like “by jingo” would, as in “By jingo, you can’t help but understand the forces of supply and demand when they’re literally happening around you.”

There, he was talking about growing up in Australia, where he once worked as a bookie’s runner. “In my defense,” he says, “gambling with bookmakers in Australia is legal. The fact that I was 15 at the time was not legal.” He took the job because it allowed him to indulge his passion at the time: betting on horses. He didn’t realize then he was preparing for his future as an economist.

“Being a bookie’s runner is a lot like being a runner on the floor of the stock exchange,” he said. “We call it betting but people are buying and selling stocks in a horse. I’ve always argued — and no one’s understood it or believed me — that it was good training.”

Now, Wolfers uses betting in the classroom. During a recent class, he told a group of his MBA students that he could read their minds and he was willing to bet on it.

The wager involved a coin-flipping exercise. Students would flip a coin 30 times and record the results in one column, then create another column of fake results. Wolfers bet he could guess which column contained the genuine results and which the made-up ones.

Almost the entire class of 35 students placed a $5 wager. Some wondered what Wolfers would do if he lost to everyone after he revealed he only had $25 in his wallet. He didn’t seem worried: “I’ll call a banker,” he assured them, turning on Kenny Rogers’ “The Gambler.”

Wolfers left the class $50 richer.

He explained his selection strategy this way: He would look for the column with the longest streak and pick that one. If there were a tie, he’d look for the second-longest streak and choose that column. Ditto for a third or a fourth. If no column stood out, he’d guess the first.

“The moment you understand a betting market, where the value of things goes up and down depending on what you don’t know, you realize it’s a financial market,” Wolfers says. “The whole idea is just to use gambling as a way of teaching how markets work and how people make mistakes in markets. The first lesson in finance is markets are smarter than you are.”

Later in the same MBA class, with his winnings tucked safely in his wallet, Wolfers started a discussion on the assigned reading: a 1985 work dispelling the existence of “the hot hand” in basketball. The study showed that while players and fans believe a shooter’s chances of making a basket are greater after a prior hit than after a prior miss, an analysis of shooting records, including free throws, proved that not to be true.

The students, especially basketball fans, were not happy with the study’s conclusions and had a lot to say. “I know the hot hand exists because I’ve had it,” one student said. Others were eager to weigh in: “Look at the pens in the air,” Wolfers observed at one point.

He neatly parried and sparred the students’ arguments: Someone who makes three baskets will likely receive increased defensive coverage, they said, thus making a fourth basket more difficult. Fine, Wolfers replied, but the authors also looked at free throw records, where no defense is involved, and the outcome was the same. The study doesn’t take psychological factors into consideration, they argued. It does, Wolfers replied: the statistics spoke for themselves.

The debate lasted for more than half the class.

Later, Wolfers says, “I love teaching that paper. People get so upset…. Everything in the hot hand paper isn’t about theory. It’s about facts. If you believe in the hot hand, you believe the guy who shot three baskets is more likely to hit another one than the guy who just missed three baskets, right? That’s a testable hypothesis. Let’s look at the data. The data doesn’t agree with you. That’s a fact.”

Showman, Taskmaster, Influencer

Teaching, especially on the MBA level, requires a bit of performance, Wolfers says, and “that does not come naturally to an academic. We’re all shy nerds.” But he enjoys it. He first noticed this, he said, when he was tutoring students in math after high school. “I remember it as an amazing high for hours after. I remember explaining it to my mother, who is a math teacher, and she said, ‘Yes. That’s teaching,’” he recalls. Wolfers was 27 when he began teaching at Stanford, where the average age of his MBA students was 27, “and I was appropriately scared,” he says. Now, at Wharton, he finds his average student has six years of impressive work experience.

“Working with these students, they really know financial markets, and I was back to being a bit scared again, which is good for you, I guess,” he says. “But I realized everyone is an expert in narrow things and my job isn’t to be narrow.”

Despite his protestations to the contrary — and repeated references to himself as a “nerd” — Wolfers seems like a natural showman in the classroom. He’s quick with a quip — noting some of the students didn’t have coins to flip, he said, “This is the problem with MBAs. You’re flipping $100 bills.” — and has a flair for the theatrical, like when he played “The Gambler” as the students tallied tosses. But he’s also able to go mano a mano when it comes to debating theories while offering countless examples — from football to elections in Zimbabwe — to support his positions.

His engaging manner in the classroom makes even the most challenging material more accessible to his students. Last year, Wolfers won the Wharton MBA Core Teaching Award which is subtitled “Tough, but we’ll thank you in five years.” He’s clearly proud of the win and excited about the potential he sees in the students he teaches.

“I would imagine one-fifth of Congress has MBAs and my guess is that in 20 years time it will be one-third. So counting CEOs and college presidents and the like, I can imagine that, in 20 years time, having taught 360 students a year, I will have been able to teach economics to some very successful people,” Wolfers says. “That will be fun. Maybe they’ll ask me to be treasury secretary.”

It’s quite possible that, if not Wolfers, then someone he knows will one day oversee the country’s financial future. Already, he has friends who are Nobel laureates or advisers to would-be presidents.

“I think economists should be useful. In the U.S., there’s a close link between academics and politics,” he says. “It’s exciting and it’s weird. It’s weird because I never expected to know very important people. I still get to be the wide-eyed Australian who gets to be amazed to even meet these people.”

But now he and “these people” are on equal footing. Wolfers talks about his excitement when Becker critiqued his and Stevenson’s paper on happiness during a recent conference — “Something like that is really thrilling and he said good things, which was incredibly gratifying. I would have cried if it had gone badly,” he says — but he has also questioned some of his hero’s research, coming down on a different side of the death penalty as deterrant issue. (Wolfers and co-author John J. Donohue found no evidence the death penalty deters murder whereas Becker and his co-author said that it does.) It is Wolfers whose writing appears on editorial pages nation wide, who blogs for major newspapers, who continues to find new ways to analyze and assess.

Wolfers firmly believes that it is his job, as an academic and an economist, to improve the lives of people worldwide. The keys to how to do that are out there just waiting to be discovered. The trick is finding them and using them.

“Economists think there’s truth and all you have to do is be honest and you’ll discover it,” he says. “It means we all wake up every day excited to go discover something.”