Starting half.com, Infonautics, and an anti-spam company called Turntide has led serial entrepreneur Josh Kopelman to rethink tenets of business orthodoxy. Foremost among them is the notion that entrepreneurs have to find radically new niches. “If I see a white space in the market, my belief is that you have to wonder why it’s there. Have there been 20 other people who’ve tried to solve it and weren’t able to? “I don’t like to solve new needs. I like to solve urgent and pervasive needs but do it in a different way.”

Starting half.com, Infonautics, and an anti-spam company called Turntide has led serial entrepreneur Josh Kopelman to rethink tenets of business orthodoxy. Foremost among them is the notion that entrepreneurs have to find radically new niches. “If I see a white space in the market, my belief is that you have to wonder why it’s there. Have there been 20 other people who’ve tried to solve it and weren’t able to? “I don’t like to solve new needs. I like to solve urgent and pervasive needs but do it in a different way.”

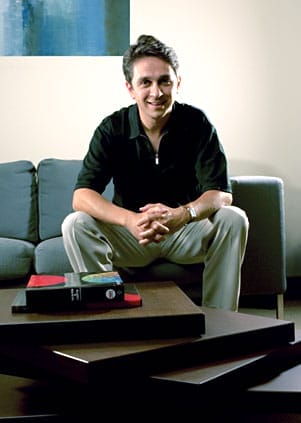

Kopelman, who now runs a venture capital firm in West Conshohocken, PA, called First Round Capital, believes that many aspiring entrepreneurs misunderstand the role of risk-taking in startups. Entrepreneurs have to be selective risk-takers, not rash gunslingers, he says. They have to look for chances to reduce risk, where they can. But when big enough opportunities pop up, they shouldn’t fear taking a calculated plunge.

When he started Half.com, which Kopelman sold to eBay in 2000, Amazon already had shown that folks would buy books and CDs online. And Kopelman knew that many of his friends and family members had shelves groaning with old books and CDs that they would be happy to unload. But no site had emerged to dominate sales of used materials. (Unlike larger, more expensive items, these didn’t seem sensible candidates for online auctions.)

He explains, “When you’re looking to solve an urgent and pervasive need, there are advantages to understanding Main Street’s needs, not just the needs of Silicon Valley.” At Wharton, Kopelman serves on the board for Wharton Entrepreneurial Programs.