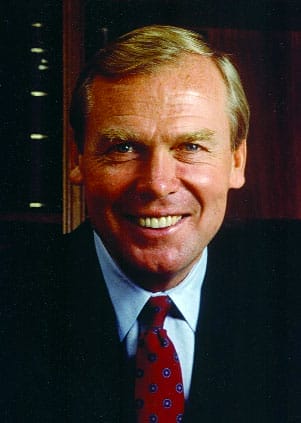

The story of Jon Meade Huntsman is the stuff of which the American Dream is made: threadbare upbringing in Blackfoot, ID, to Wharton graduate, to patriarch of what was the nation’s largest family-owned and-operated business.

The story of Jon Meade Huntsman is the stuff of which the American Dream is made: threadbare upbringing in Blackfoot, ID, to Wharton graduate, to patriarch of what was the nation’s largest family-owned and-operated business.

At the apex of that often-bumpy journey, he found himself one of America’s wealthiest people and among the nation’s top 25 all-time philanthropists. Huntsman is also a wealthy man in terms of family. He and his wife Karen have nine children (including five Penn graduates, one of whom is Jon Jr., C’87, the governor of Utah) and 55 grandchildren. Huntsman’s company, Huntsman Corp., a Utah-based chemical conglomerate, had 2005 revenues of $13 billion. Huntsman is also widely known for his philanthropy: He has given more than $200 million to establish the Huntsman Cancer Institute and Hospital at the University of Utah.

Anyone with a link to Wharton knows Huntsman’s name. He is, after all, the largest benefactor in Wharton’s long history and a leader in the Campaign for Sustained Leadership, which in 2003 became the most successful campaign ever at any business school. His gifts established the Huntsman Program in International Studies & Business, a dual-degree program for undergraduates, and he has been honored as the namesake of the School’s newest state-of-the-art building.

Huntsman grew up in Idaho, the son of a schoolteacher. He attended Wharton on scholarship and hatched his fortune out of eggs—or rather egg containers. He dreamed up polystyrene containers for eggs after working for his uncle, who sold his eggs in old fashioned, less protective cardboard. Eventually, Huntsman started his own container company, which, among other things, created signature “clamshell” boxes for McDonalds’ Big Macs. In 1976, Huntsman sold the firm and then re-purchased part of it back. Thirty-five years and many mergers later, Huntsman Corp. is one of the world’s biggest chemical makers.

Huntsman has also known hard times, having survived prostate and mouth cancer. And his company nearly went bankrupt in 2001 when its cyclical industry slumped. Lawyers, business associates, and friends urged Huntsman to cut his losses by declaring bankruptcy, but Huntsman refused. He arranged emergency financing, and his long private company went public in 2005.

Asked by Forbes magazine about his first big break, Huntsman recalled the following: “It came during a very difficult period—the Arab oil embargo of 1973–74.… Breaks often come from a difficult period, from being forced to deal with things that come up. I’ve always viewed hurdles and challenges as opportunities to move ahead.”

Huntsman, Chair of Wharton’s Board of Overseers, former Chair of the Campaign for Sustained Leadership, and Vice Chair of the University’s Board of Trustees, chronicled his own story in Winners Never Cheat: Everyday Values We Learned as Children (But May Have Forgotten), published by Wharton School Publishing in 2005.