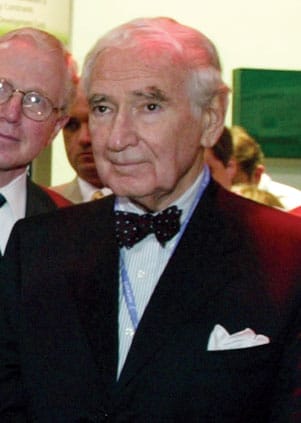

Comcast Corp’s prospects are tied to founder Ralph Roberts’ all-too-logical belief that Americans love television and sports more than just about anything.

Ralph Roberts founded Comcast in 1963 with the purchase of American Cable Systems, a community antenna TV system in Tupelo, MS. He had acquired an entrepreneurial streak after growing up during the Depression, when his once-affluent family lost everything. “My father died, and we lost all our money,” he told the New York Times in 1997. “People who never had a financial problem in their lives can never understand what terror there is in that.”

He began his business career as marketing vice president of Muzak Corp. and was then recruited by Pioneer Suspender Company in the same role. Later, with the help of the Philadelphia National Bank, he purchased Pioneer, which manufactured belts, wallets, jewelry, and other men’s accessories. Roberts traded in fashion for cable to purchase American Cable Systems. He then asked Julian Brodsky and Dan Aaron to join him. In 1969, the company was renamed Comcast. It went public in 1972.

Today, Comcast is one of the most important and influential media companies in America with 24.2 million cable-TV customers, 11.5 million high-speed internet customers, and nearly 2.5 million voice customers. It is the nation’s leading provider of cable, entertainment, and communications products and services.

Like most of today’s large cable companies, Comcast grew through internal growth and acquisitions. It has always aligned itself with promising young companies. In 1986, for instance, Franklin Mint founder Joe Segel, W’51 (also featured in this issue), called on Ralph Roberts with an idea for a television shopping channel. Ralph Roberts, wowed by Segel’s track record as a serial entrepreneur, agreed to be a founding investor in the business and feature it on Comcast’s cable systems. Comcast acquired controlling interest of QVC in 1995, later selling its interest to Liberty Media for $7.9 billion. In 2001, AT&T Broadband agreed to sell its cable unit to Comcast for $47 billion in stock and $25 billion in assumed debt. That historic deal, by far the largest ever in the cable business, was completed in November 2002 and gave the company over 21 million cable subscribers in 41 states, more than twice that of its closest competitor, Time Warner Cable.

A key to Comcast’s ability to maintain a family-like culture is due in part to Roberts’ decision to create two classes of stock which allowed for voting control by a member of the family. Today, Brian L. Roberts, W’81, son of Ralph Roberts, is Chairman and CEO of Comcast.