The late 1980s and early 1990s were turbulent times for the banking industry, but Charles S. Sanford Jr. was determined to advance Bankers Trust when he became chairman in 1987, and transform it from a second-tier lender into the highly profitable business of trading and custom dealing.

The late 1980s and early 1990s were turbulent times for the banking industry, but Charles S. Sanford Jr. was determined to advance Bankers Trust when he became chairman in 1987, and transform it from a second-tier lender into the highly profitable business of trading and custom dealing.

During his tenure, Bankers Trust became a leader in challenging the status quo, instituting changes that were subsequently adopted broadly by the banking industry. These included: creating a process for measuring risk (RAROC), which became the foundation for regulatory standards to measure bank capital adequacy; acting as placement agent and then underwriter for issuers of commercial paper and, subsequently, entry into the debt and equity markets in competition with investment banks; conceiving and developing the business of the origination and distribution of loans that included the distribution of loans to other market participants, which was the forerunnerto the establishment of an active secondary market for loans; developing dynamic businesses around transaction processing services, which had previously been provided as an appendage to lending relationship; and becoming an architect of the modern use of derivatives, which are now used by corporations and institutions worldwide to manage risk.

RAROC is the cornerstone of modern risk management and derivatives are the fastest growing financial market—a testament to Sanford’s determination to make banking more dynamic and innovative. Upon Sanford’s retirement in 1996, Bankers Trust Director Hamish Maxwell, retired chairman and chief executive officer of Philip Morris Companies, Inc. (now known as Altria Group, Inc.), said, speaking for the board: “Charlie Sanford has been the principal architect of what has been recognized during his chairmanship as one of the most innovative and profitable global financial institutions.”

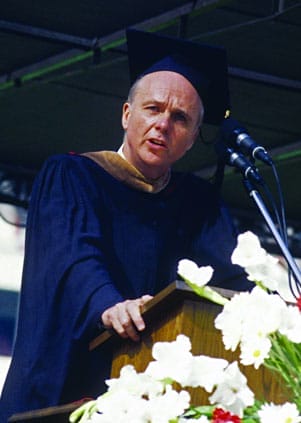

A former Wharton Overseer, Sanford once told Wharton MBA students at a convocation that it was in their interests to practice what he called “enlightened capitalism,” that is, “a capitalism that will create a surplus and reinvest in social and material productive capacity for posterity.…Enlightened capitalism is a system that responds to general human needs while serving individual human aspirations—certainly including personal financial security.”