In September, a Barron’s article dubbed gene therapy as a revolution with tremendous promise over the next five to 10 years. The story cited several contributing factors, including: a more lenient regulatory pathway; big pharma’s growing interest in the field; and gene therapy’s potential to provide dramatic improvements in health, which could reduce approval times, compared to traditional drug therapies. Still, questions remain: Is gene therapy real? What are the challenges facing companies in this market?

As a host of Sirius XM channel 111’s “The Business of Health Care,” I recently had the opportunity to interview two guests deeply immersed in the gene therapy market from a development, commercialization, and evaluative standpoint: James M. Wilson, the director of the Gene Therapy Program at the Perelman School of Medicine and Rahul Kapoor, an Associate Professor of Management at Wharton.

Wilson has studied the nexus of this emerging therapeutic area from its birth. He’s also interested in how best to take academic research from bench to bedside. This curiosity has led to some very important insights into how best to commercialize gene therapy. Among them: keeping Big Pharma out of the clinical development process; ensuring the reimbursement for these expensive treatments is sufficient; and designing appropriate business models for one-time therapies, rather than the traditional mass-market models the pharma industry knows best.

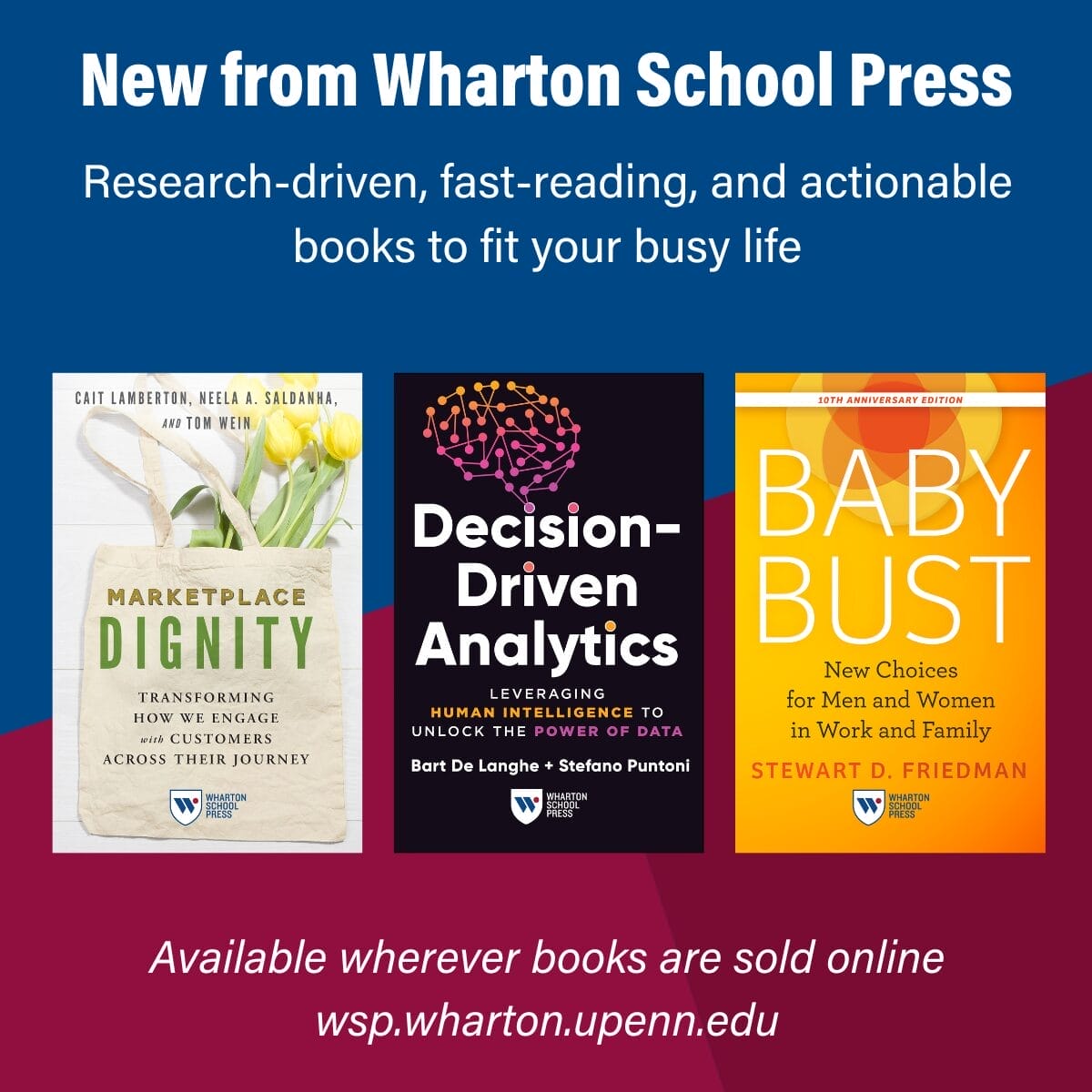

Meanwhile, Kapoor has focused on how firms organize for innovation and manage technological and industry-level changes. Both recently co-authored an article in Nature Biotechnology’s September issue which reported that investments in gene therapy have taken a sharp decline since 2002, and that the number of issued patents has halved since the same year (down from 1,400 to approximately 700 today). However, Wilson and Kapoor also noted that the market is beginning to rebound. They’re cautiously optimistic, while Barron’s appears very bullish.

While Wilson and Kapoor are cautiously optimistic about the future of gene therapy, they point out that the commercialization of gene therapy has experienced some interesting twists and turns. Big pharma (the likely beneficiaries of gene therapy research and development) has stayed away from significant investments in gene therapy due to major technical and regulatory uncertainties. What are these uncertainties?

The gene therapy market is a different animal than what big pharma is used to, with the mass production and marketing of life long drug therapies. These drug therapies are relatively easy to forecast, price, and model. Contrasted with gene therapy, which is personally customized, “curative” therapy likely carries a big price tag. Big pharma has a difficult time wrapping its head around the issues of gene therapy’s manufacturing, pricing, and gaining reimbursement. So what has been the result of these uncertainties? It appears research centers at the University of Pennsylvania are doing most of the clinical development, though this work has traditionally been done by pharma companies. Kapoor postulated that if pharma companies were made responsible for development and commercialization decisions regarding gene therapy, products are less likely to be commercialized, while pharma alliances with startups and universities like Penn would result in better outcomes. In other words, these therapies will be successful if pharma focuses on its competencies and stays out of the R&D and clinical realm.

Wilson also discussed issues with pricing these therapies, which likely carry hefty price tags due to their potential curative nature. These difficult questions include: how will one evaluate the curative nature over the life of the patient; should the pricing be levied over time versus a one-time hit; what happens if the cure really is not a cure; should the existing therapy be repriced/discounted if newer/better therapy is introduced; and who should evaluate the efficacy over time?

While many others exited the gene therapy market in the early 2000s, Penn has continued its efforts, and is currently sitting pretty with the infrastructure to move forward with clinical development. Kudos to the person at the medical center who decided to keep at it—Penn will likely reap myriad benefits. With Penn’s clinical work, therapies for blindness and hemophilia look promising. Professors Wilson and Kapoor agree it’s an exciting time for Penn. Stay tuned.

For audio of this episode of “The Business of Health Care” on Business Radio Powered by the Wharton School on Sirius XM Channel 111, click below: