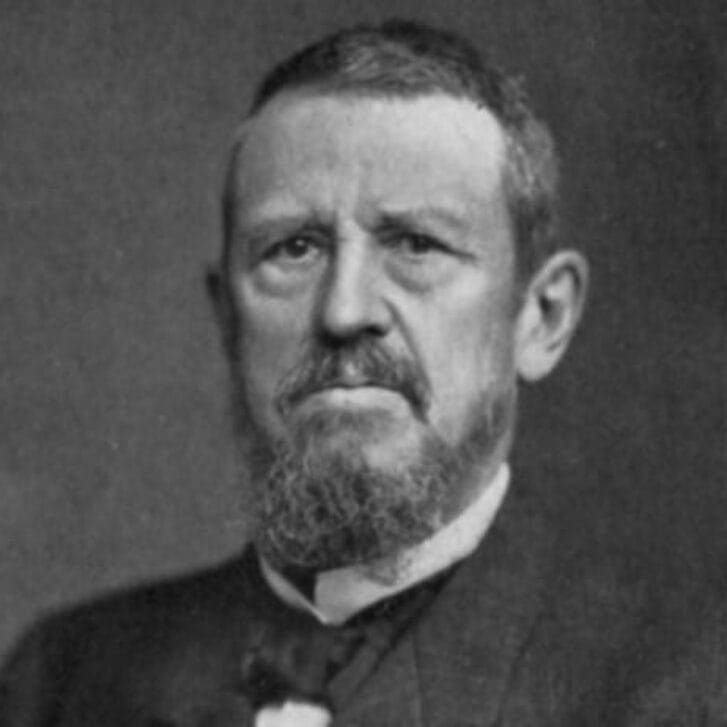

Alfred Berkeley III became president of the NASDAQ Stock Market in 1996, back when it was a helter-skelter kind of place—full of potential, but still with a few rogues in its midst. Berkeley had had a long run as a successful executive at Alex Brown Inc., and wanted to bring status and stability to what had become, in the run-up to the big technology stock boom, the country’s second-largest stock market, bypassing the traditional ones like the American Stock Exchange.

Berkeley, who received his MBA from Wharton in 1968, faced a quandary: How could NASDAQ be more palatable for traditional customers? “My philosophy is that customers have to come before brokers and all investors have to be treated equally,” Berkeley told the financial press. “And I believe that technology is the way to implement performance and policy issues.”

Berkeley put in strict rules for trades and company reports, quelling the over-pricing scandals that had dotted the NASDAQ’s past, and pushed computerization and other standards in high-tech trading that made NASDAQ not only palatable, but for many the preferable way to enter the market. No longer did companies rush to the New York Stock Exchange once they became bigger—Microsoft, Intel, Amgen, and other maturing multibillion companies stuck with Berkeley and his newly respectable NASDAQ.

After the NASDAQ slide of more than 50 percent in 1999 and 2000, Berkeley decried the rise in speculation, as opposed to long-term investing. He pushed NASDAQ companies to accept more rigid standards for investment and accounting, which attracted more institutions and individual investors—the basis for successful long-term stock exchange success. His technological innovations improved time-lag problems for traders, making cheating on the margins of those trades next to impossible. Under Berkeley’s rule, NASDAQ became not only a hot market, but a leader in trading efficiency. Berkeley retired from NASDAQ in 2003, and is chairman of Pipeline Trading Systems, a registered broker-dealer specializing in electronic block trading of securities, that is a subsidiary of e-Xchange Advantage Corp., where Berkeley is also chairman.