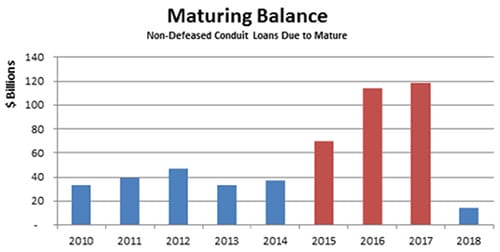

Starting this year through 2017, $350 billion in commercial mortgage-backed securities (CMBS) loans will mature, leaving hundreds of real estate owners on the hook to refinance and infuse new capital into their properties in order to keep their real estate ventures operating. Enter real estate crowdfunding.

While the Federal Reserve has inflated asset values over the past six years, Trepp projects that close to 20 percent of the commercial mortgages maturing over the next three years will require further capital—either from current borrowers or new buyers—when the loans are refinanced or the properties are sold.

Source: Trepp

A decade ago, in the two-year period between 2005 and 2007, $600 billion in CMBS was issued. This happened before the recession hit, and the commercial real estate lending market was extremely competitive.

The market was so hot that borrowers were able to secure interest-only financing with loan-to-value (LTV) rates exceeding 80 percent. And those LTV rates increased each year between 2005 and 2007, as the lending market grew more and more competitive.

Of course, that kind of lending came to a halt when the recession hit and the commercial real estate industry started experiencing a wave of defaults on loans.

Now, with the coming wave of more than $300 billion worth of loan maturities, owners and originators across asset classes agree that capital markets will fall short. They won’t be able to lend as aggressively primarily because of rising interest rates.

Real estate has rebounded in many parts of the country. Banks are lending more aggressively amid growing competition and interest rates remain low. However, Fed officials have stopped offering forward guidance and investors remain concerned about an interest rate hike, possibly as early as this summer.

Many of the borrowers from the 2005 through 2007 vintages may struggle to obtain LTV’s that were available during the height of the boom. Again, this will result from interest rates and lenders being more cautious post-recession, especially on riskier projects. Consequently, there will be a huge need for fresh capital, whether debt or equity, to fill the gaps left by more conservative senior lenders.

While property values have improved significantly since the recession, the recovery has not been uniform. Core markets like New York, Washington, D.C., and Los Angeles have experienced a flood of capital as investors search for yield. However, asset values in secondary and tertiary markets haven’t kept pace with the coasts, requiring an infusion of new capital.

Smaller borrowers will likely consider new capital sources to make up a larger portion of the capital stack. Whether regional banks, institutional investors, or debt and equity via real estate crowdfunding platforms, small-scale developers are identifying alternative funding sources to help in refinancing.

Real estate crowdfunding offers “just in time” funding, available in two to three weeks, allowing sponsors to go direct to the investor. The inefficiencies and extra fees of money managers, funds and RIAs are avoided by allowing the sponsor to raise capital directly from individual investors, lowering a sponsor’s cost of capital and aligning interests.