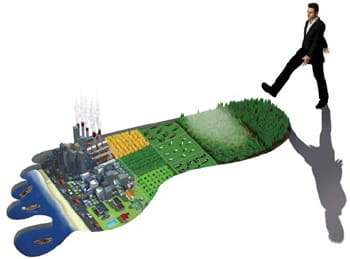

We often forget that the economy is a 100% subsidiary of the environment, and that this relationship dictates the health of our economy. Our actions seem to suggest otherwise, however, with much of our global consumption coming at the expense of the environment, and a lack of perceived need to keep our “planetary bank” intact. Our quest for economic growth, and increasing globalization, has allowed resource extraction and production to move across borders where natural assets were more abundant, and manufacturing costs cheaper. Now with growing populations, there are more of us wanting to consume yet the environmental assets in the “planetary bank” are no longer so easily available to harness in such quantities. Yes, many companies have access to the natural capital that still exists, but the “interest income” which used to come from the environmental assets that surround us has been plundered, paved or penetrated beyond the ability to yield what nature had intended.

Many environmental economists have suggested for decades that we need to put a cost on the right or ability to pollute, damage, and extract. This would create a proper user pays program which would deter blatant exploitation and ensure sustained consumption while creating a pool of funds for more rapid repair. The problem we face today in many countries, is that with a widening wealth gap, it becomes harder and harder to start charging for the environmental externalities we cause, because a growing part of the population cannot afford to pay to put nature back in order. Many industry sector wages have not kept pace with inflation, creating a wealth gap with only those privileged having access to many of these planetary assets.

We have ended up in a downward spiral, with large populations seeking cheaper goods from faraway places where laws are lax and resources are often easier to exploit. This spiral continues as economies of scale are more easily created due to advances in technology, robotics, and growing populations to cater to, meaning that competition and efficiencies bring pressure on prices. This price deflation has helped some of the slowing economies of the West defray the reality of changed domestic circumstances, but it can only go so far (down) in the current mode of operations. At some point that “bank of nature” we have been withdrawing from, coupled with the chase for cheaper production, will hit a limit.

There is room for hope however, as an incredible environmental revolution and transformation is now beginning to take place, buoyed by a significant psychological boost from the Paris COP21 Climate Talks. This is not because a silver-bullet solution was offered to fix our climate ills, but for the first time in decades, over 190 countries all agreed on the same thing – that we need to collectively move to slow the advent of our planet’s environmental degradation. This momentum, coupled with the revamp of the United Nation’s Sustainable Development Goals, and the drastic, unexpected fall in oil prices has opened a large window for the environmental revolution to begin, and in a way that those in Paris did not even consider possible. Now, more and more corporate leaders are creating visible, engaged, and bold mid-term goals for the same broad objective – that of reducing their environmental footprints or actively creating net improvements. These moves are complemented by municipal government leadership, the rapid growth in the green bond market, and the awakening by pension funds, asset managers, and investors to the fact that long-term carbon liabilities are truly liabilities. New long-term investment opportunities for energy, air, water, and natural capital will exist mainly in the clean-tech space. This shift of thinking will exacerbate the decline of the fossil fuel economy while spurring economies of scale with the clean technologies that are now already beginning to compete with oil at $30/barrel, and without the subsidies that much of the carbon-based markets survive on.

Brands that can show that they are engaged in improving the long-term livelihood of the communities and clients they serve will be the ones that thrive, while those that wait for a “stable economic environment” to begin to address environmentally sustainable practices will fall by the wayside. Brands have generally been commoditized as a result of the quest for cheaper products and larger markets, but the differentiation, creativity, and pride that consumers seek in their products has been largely lost.

Research from the book “The Brand Bubble” by John Gerzema and Edward Lebar has shown that brands are now less respected, with awareness of brands falling at the same time, due primarily to excess capacity, lack of creativity, and the loss of trust that the brand conveys. Brand quality perception fell by 24% over a recent 13-year study, and differentiation of brands declined in 40 of 46 categories analyzed by Copernicus/Market Facts.

Consumers are now assessing brands based on the benefits they expect to receive in the future, and the ability for them to surprise, bring a sense of energy to the product or service, and engage with their consumer base to build a sense of long-term, engaged mutual trust, with brand loyalty moving from a passive to an active state.

This new brand imperative is a business imperative, and much of this expected differentiation from consumers can come in the form of strong environmental engagement. Stakeholder-centered firms tend to achieve more “emotional consideration,” while having over 50% more pricing power than their un-engaged peers. Intangible value is now more than 60% of the $31 trillion of global market value according to Brand Finance, and companies that show proof of giving back to the environment will have a strong advantage over those who are not perceived as embracing this topic.

The environmental revolution that is coming, or is already upon us (for those who see it), is the biggest factor of hope that most companies have to engage, differentiate, survive, and thrive in a resource-constrained world. This will require a big change of mindset for many, and a move away from the short-term expectations of the stock markets. Today the brand is the most valuable asset in a company’s portfolio, and failure to remember that the next generations need to earn yields from the same “planetary bank” that we have taken large withdraws from, will be noticed by the customers companies are trying to serve. Social media, rapid access to information, and transparency in reporting have all meant that for companies to build trust, and their brand value, they need to be involved with this positive change impacting the recovery of our natural assets. As a subsidiary of the environment, long-run economic health will only be achieved if sustainably managed operations form the basis for the way the economy functions.