Joe Battipaglia was in the hot seat. It was October of 1997, at the height of the Asian financial crisis, and Battipaglia was one of three experts being interviewed on the Larry King Live show about the U.S. stock market’s related nosedive.

The trio discussed the market’s recent gyrations at length. But as the show came to a close, Larry King turned his attention to Battipaglia, WG’78. “He said ‘Joe, we only have a couple of minutes. What’s going to happen tomorrow?’ ” Battipaglia recalled. “I said, ‘Larry, I think the market goes down 100 points or so in the first hour and then there’s going to be a rally.’ ” King then asked Michael Metz, an analyst from Oppenheimer, the same question. Metz strongly disagreed with Battipaglia, saying the recent volatility signaled the end of the bull market. The third expert, the head of the banking committee, declined to offer an opinion, claiming he did not want to influence the markets.

Battipaglia didn’t give the interview much thought on his way home that night – television interviews, after all, have become routine for the chairman of investment policy for Gruntal & Co. But when he arrived home, his wife Maryann was clearly nervous. “Now, she usually doesn’t get nervous about the markets and what I do,” Battipaglia says. “So I pressed her a little about what was wrong. She said, ‘Well, the president of Gruntal called.’ ” Battipaglia asked her if he had seen the Larry King show. “Yes, he saw it,” she said. “And he said you better be right.”

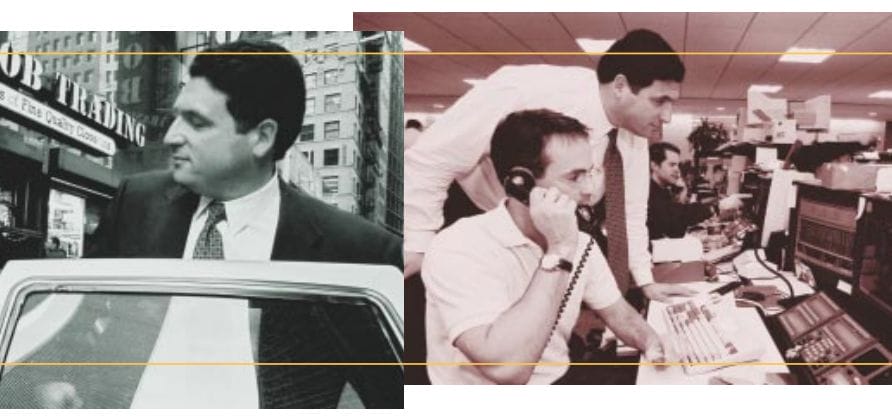

When Battipaglia arrived in New York the next day the canyons of Wall Street were lined with reporters hungry for predictions from Battipaglia and other Wall Street strategists. Battipaglia did a few more interviews on the street, maintaining his upbeat view.

And as if on cue, the market dipped then rallied that day. “It worked out that the bullish case and buying on that dip was the right answer,” he says. “Those are the times, as a strategist, that you really make a difference – when the call is ever so critical. That’s what people remember.”

Battipaglia, 44, says he never worried, despite the call from his boss, his somewhat shaken wife and swarms of reporters lining Wall Street’s sidewalks. “I sleep very well at night,” he says. “There’s a fundamental belief that the U.S. economy is on a significant growth trajectory and that investors will do the rational thing and are smarter than Wall Street gives them credit for. Bear markets tend to be short lived. Thus, you have to look for the seeds of the next bear market, and if you don’t see them, you stay fully invested. If you’re in the midst of a bear market, more than likely you can ride it out in a positive way. With that as a fundamental backdrop, I rarely get shaken.”

Indeed, Battipaglia seems entirely unflappable. A day spent trotting behind this giant of a man – he is 6’7″ tall – revealed an evenness uncharacteristic of someone who makes his living trying to predict the habits of the most inscrutable of creatures: the financial markets.

Wall Street Media Star

It’s Tuesday, February 29, 2000 at 6 p.m. and the New York Stock Exchange is stone quiet and empty other than the crew from CNBC, the financial news network that camps at the exchange each evening to review the day on Wall Street.

The largely young, artsy producers and technicians sprawl on metal chairs, grazing on Oreos and trail mix and waiting for the broadcast to begin. Battipaglia greets the talent – Ron Insana and Sue Herera – both already coated in their waxy on-air makeup, and talks about children, spouses and upcoming vacation plans. He wanders restlessly around the exchange floor, eventually finding his way to a tall director’s chair where he too is swathed in stage make-up by a black-clad make-up artist.

It’s been a sizzling day on the NASDAQ, which topped 5,000 for the first time in early day trading, and Battipaglia has fielded calls from reporters and producers all day. He wades between the tangle of wires and cameras and sits next to Insana. A production assistant clips a tiny microphone inside his jacket and the countdown to airtime begins.

Six weeks later, during the second week of April, all three major market measures suffered their worst point drops ever, wiping out $950 billion in a single day, just shy of Brazil’s $1 trillion gross domestic product.

On Friday, April 14, the Nasdaq Composite Index, led by Qualcomm Inc. and Intel Corp., fell 355.49 points. The 9.67 percent drop was the Nasdaq’s second worst, just behind the 11 percent free fall on Oct. 19, 1987 and capping the worst week in the much-watched index’s 29-year history.

In a lineup of interviews from the Today show to CNBC, Battipaglia was once again called upon to dissect the market free fall, and to calm investors’ rapidly rising fears.

“Our view is still the same,” he said during in an interview immediately following the market plunge. “What we have just witnessed is a fast, deep, sharp correction of one third of the value of the Nasdaq and 12 percent of the value of the S&P 500. But we are still in a bull market. We are looking for four percent growth on the economy and 14.5 percent growth in S&P earnings, a 30 percent growth in Nasdaq earnings, a situation where inflation stays below 2.5 percent for the year, and the Federal Reserve, which has already engineered five rate increases, adds one more, and that will be it. We will roll into the election in an environment where stocks will outperform money funds for the balance of the year, and we are not changing any of our targets or our asset allocations.”

Battipaglia isn’t exactly a household name, but his near-constant presence in the media has made him a personality of sorts. An April Business Week story that took a somewhat disparaging view of Wall Street and the media’s role in hyping the stock market cited his number of television appearances – 238 within the past year – second only to influential Goldman Sachs economist Abby Joseph Cohen’s 259. Television, the article said, is fueling a trend toward media-savvy “celebrity” analysts and strategists who tend toward overly rosy views of the market and have the power to move markets, sometimes dramatically.

Battipaglia seemed undisturbed when asked about the article. “The people who have the most media hits are the people who work for full-service brokerage firms – people like myself and Abby Joseph Cohen at Goldman Sachs. Our job is to pro-vide advice and guidance to clients on a regular basis. It’s not inconsistent with a full-service environment to see analysts with this kind of public profile,” he says.

He acknowledges, though, that few analysts today take a publicly critical view of a company, and that out and out “sell” calls have become a rarity. “I sell all the time, so I can take myself out of this one,” he says. “But there is a bias, there’s no question about it, in the analytical community against selling equities. There shouldn’t be, but that’s the way it is.”

Battipaglia says that while it’s true he’s one of Wall Street’s best known bulls, that bullishness simply reflects a fundamental long-term view of investing, not a desire to boost markets. “We at Gruntal stayed pretty much committed to a bullish case throughout the decade of the ’80s and into the ’90s, and it has served our investors very well,” he says. “There are as many ways to trade the stock market as there are stocks to buy: momentum, technically, short-term, long-term. But I have always approached this from a long-term point of view that is fundamentally driven, and the key inputs are the level of economic activity, domestically and internationally; the relative stability or instability of price levels in the real economy; confidence as measured by consumerism; voter habits and investor preference. Looking at those measures are what compel our forecasts for the next 12 months.”

Battipaglia got his start on the media trail in the early 1980s when a business news start-up called Financial News Network called one day looking for a market expert. “Abby Cohen just wasn’t physically there all the time,” he says. “But I was. We didn’t have a big institutional practice so I wasn’t running around the country.” Battipaglia, the media found, was a good interview: he summarized quickly, used colorful, simple language and exuded calm. This steady, down-to-earth persona, says Wharton classmate and former roommate Michael Gilson, is signature Battipaglia. “I’ve known him for 24 years and he’s always been the same way,” says Gilson, co-founder of Advanced Aerospace Inc. of San Luis Obispo, Calif. “What is unique about Joe is his ability to speak in terms that the average person can understand.”

Over the years, cub reporters moved onward and upward to larger networks, and kept Battipaglia in their rolodexes. “It evolved. It just evolved,” he says. “And as the market got stronger and bigger, the public’s attitude about and interest in business news changed and grew. From my personal perspective, I knew that if I wanted to truly compete with my peers, I had to be visible. I knew that I had to stand the test of time and see whether my work really did hold its own.”

A Kid From Queens

Joe Battipaglia grew up an only child in a small, fourth floor apartment in Queens, New York. His mother Ann, now 81, worked at Bloomingdale’s and his father, Joseph, was a crane operator for the sanitation department of the City of New York. Joseph Battipaglia Sr. had two dreams: to own his own home and to make a fortune in the stock market. Ultimately, he was unsuccessful at both and died in his early 50s.

Joe Jr. was the first member of his family to go to college, attending Boston College in the early 1970s and graduating with a degree in economics. But when he graduated in 1976, the U.S. was mired in a recession and Battipaglia had few job prospects. He decided to go to business school, choosing Wharton because it was close to New York where his mother then lived alone as a recent widow. “As an only child, I needed to be near home,” he says. “Wharton was the clear choice for me.”

After earning his MBA, Battipaglia bypassed Wall Street and accepted a job working in the controller’s office at Exxon in Manhattan. After four years and with his interest in moving into Exxon’s marketing department stymied, he decided to become an analyst at Elkins & Co., one of the three remaining large brokerages in Philadelphia. Battipaglia had married in 1980 and he and wife Maryann were drawn to the Philadelphia area as a safe haven to raise a family.

But Battipaglia began his new job during a brutal bear market. Elkins was short on funds, and relations between its partners were strained. By 1982, the principals decided to sell the company to what was then Bache, which was also in the midst of being acquired by Prudential. “So it was truly a big fish swallowing a smaller fish gobbling a small fish,” Battipaglia says. “And so within a year and a half of taking this new job, everything had changed.”

One day, the Prudential management team charged with assimilating Elkins literally walked through the office and asked each employee what their job was. “If you were a salesman, you were OK, if you were anything else, you probably weren’t going to make it,” Battipaglia recalls. Battipaglia hung toward the back of the office, observing the goings-on from a distance. By the time the team finally reached him and asked, “So what do you do here,” Battipaglia told them, “Anything you want.”

He was given a choice: interview in New York for a possible job, or become a salesman in Philadelphia. Battipaglia chose the latter. “That was a very good year for me, because I got to see how the brokerage business works on the firing line, where investors make decisions,” he says. “But for someone who had never worked in sales it was daunting because the structure is transaction-oriented and so the pressure was to open new accounts, bring in assets, create commissions.”

He enjoyed sales, but found himself doing more analysis and portfolio management work and realized that while his new account growth and commission rates were slower, he managed more assets overall than many of his colleagues. He joined Gruntal about a year later at the recommendation of a friend who worked there and described the small Wall Street firm as entrepreneurial. Gruntal had just bought a Philadelphia investment firm and wanted to boost its Philadelphia presence, and Battipaglia joined the firm as a Philadelphia-based general analyst. His first buy recommendation was Ma Bell at $17 a share. He also liked Centocor, a small biotech firm, at $12 a share, and Wyomissing, Pa.-based VF Corp., an apparel manufacturer. “It was those kinds of companies that I covered. It wasn’t the industry – it was the opportunity that I saw for the investor.” His son Matthew was born in 1982, then daughter Christen in 1984. “And here I am in Philadelphia, and everything is great.”

Eventually, though, with his star rising, the firm’s New York managers asked Battipaglia to come to New York for what he calls a “fatal, fateful meeting” with Gruntal’s president. The upshot: the president asked Battipaglia to work in Manhattan a few days a week. “After about a month, I was coming to New York full-time, every day,” he says.

He has commuted every day from Pennsylvania ever since. “We love the area, the children were acclimating to the schools, and given Wall Street’s proclivities, I thought it might be good to have a connection to both Philadelphia and New York,” he says.

Battipaglia, who says he’s not a morning person, gets up at 4: 40 a.m., hops a 5:35 train to New York and reaches his office by 7. Many days he tries to be home by six to eat dinner with Maryann, Matthew, 17, Christen, 15 and youngest son Jeffrey, 11, but often isn’t able. He says his supportive family and love of the business make the commuting bearable. But Battipaglia, a passionate skier, is also a strong believer in taking vacations and the occasional long weekend to recharge.

“For me, this is a very noble profession,” he says. “Human nature is such that we are always trying to do better for ourselves. In an evolved society, your financial health is probably as important as your personal health. And so here is a business that serves that purpose. I have always approached this as a calling recognizing that it is very humbling because you can be well intended and have all the resources at your disposal and still come to the wrong conclusions. So if you can approach the public in a candid way, with humility, then you can build a business, and that’s what I have looked to do.

“And everything you hear about the American dream is true – it’s not a fairy tale. Each generation looks to build on the successes of the ones that preceded it. I didn’t want for anything as a child – this isn’t a sharecropper’s son story – but I had very modest beginnings in Queens looking out at the sky-scrapers of Manhattan and wondering how you get there.”

As for the future, Battipaglia says he’s not necessarily interested in becoming CEO of a major brokerage despite what many might expect. Instead, in ten years or so he’d like shoot off in an entirely new direction, perhaps traveling the world and educating other nations about investing and the financial markets. He takes a typically philosophical view of such a change: he believes people should simply “leave them-selves open, and if the opportunity presents itself, then you step into it.”