In August 2011, Standard and Poor’s made the historic decision to downgrade the U.S. credit rating. Just a month later, on September 12, Douglas Peterson, WG’85, took his place as president of the ratings agency. Despite the obvious challenges he was atbout to face, Peterson embraced the opportunity to take on a global operating role during a period of change and uncertainty and left his position as COO at Citibank NA, an organization he had been with since his graduation from Wharton. Beyond his role as a manager at home and abroad, and his experience dealing with regulators and policymakers, he is a lover of jazz, archeological ruins and a devoted family man to boot.

WHARTON MAGAZINE: When you first started at S&P, it was a time some commentators called a crisis mode at S&P following the downgrade of U.S. sovereign debt. What was it like to step into that situation?

PETERSON: I would not characterize it as a crisis mode. My view is that, over the last five or six years, [S&P] has been going through a lot of change having recently become regulated, and because of that and other reasons, coming up with new processes, new procedures, new methodologies, new ways of working, etc. So I think the foundation that was put in place over the last five years at S&P is quite solid and there are opportunities to continue to improve and make it better all the time in light of Dodd-Frank and other things. So I would say that, as opposed to crisis mode, I think of it as a lot of change going on and my job is to make sure that that change is well organized, well orchestrated and well understood by the organization.The other side is that the rating agencies and S&P are in the spotlight. There is a lot of attention being paid. We’re in a very delicate, very volatile risk environment, and ratings are very visible. Many critical ratings decisions have been made, and they get a lot of publicity.

WM: Why would you want to step into the position during such a time of intense change and attention?

PETERSON: The one simple answer I would tell you is that, throughout my entire career, I have always gravitated toward the jobs that had the biggest stretch and where I felt I would have the biggest challenge and learn the most.

WM: In January 2012, S&P downgraded several European nations. How were these downgrades handled differently than the U.S. downgrade?

PETERSON: There’s a set of very well-developed, thoughtful criteria that is the core of how we develop our package for a ratings committee. In the case of sovereigns, there is a long experience—40 years and even longer—with sovereign ratings. It’s a global team in place looking at comparability and a global leveling of ratings. But then there’s an individual country review that includes several factors [external, fiscal, monetary, political and economic]. It’s a very in-depth review that’s done country by country. So for me, it’s critical that there is an incredible amount of integrity and quality in that process. But then when you get to what was different in the rollout of the European downgrades, the only thing I might say is that, because it entailed multiple countries that were being reviewed and ended up with some downgrades, some affirmations of the ratings, we decided to have a carefully orchestrated communications plan. That’s not to say that there wasn’t also a careful communications plan with the U.S. downgrade, but I wasn’t here when that one took place.

WM: How would you describe your leadership style?

PETERSON: I’ve developed over the years a conceptual model about the elements of leadership that I think are important. They’re simple. One of them is having a vision and ensuring that there is a vision for the organization. Another is certain core values. That you have integrity, and integrity is part of your system of management. The third is that you have accountability in the organization and that roles are defined, roles are clear and that people are accountable for what they do. And then the glue that holds all that together is communication. So I’m a big believer in internal communications, external communications and consistency in communications. And underlying all of that is a foundation of something that I found no matter what culture I’ve worked in and no matter where you are in the world: You need to have a foundation of respect.

WM: One of the ways you’ve been described in the press is as methodical and process-oriented. Do you agree?

PETERSON: I find that this is an interesting characterization. I’m smiling to hear this. What I don’t want to be known as is obsessive. I think of myself as process-oriented. I am methodical. Maybe the way I’ve always thought of it my whole life is that I’m really organized.I’m going to segue to an observation I’ve had. I’ve been really surprised at how many people over my career I’ve worked with who don’t follow up on things. You can organize, you can run a business, or run a team or something, and I’ve become a believer in a certain level of structure that gives your team expectations that you’re going to have a meeting on a certain cycle and you’re going to have an agenda of things you’re going to follow. Then when ideas come up, somebody’s going to be responsible for following up and tracking it.

WM: How are your Wharton knowledge and experience still helping you to have impact in your professional life?

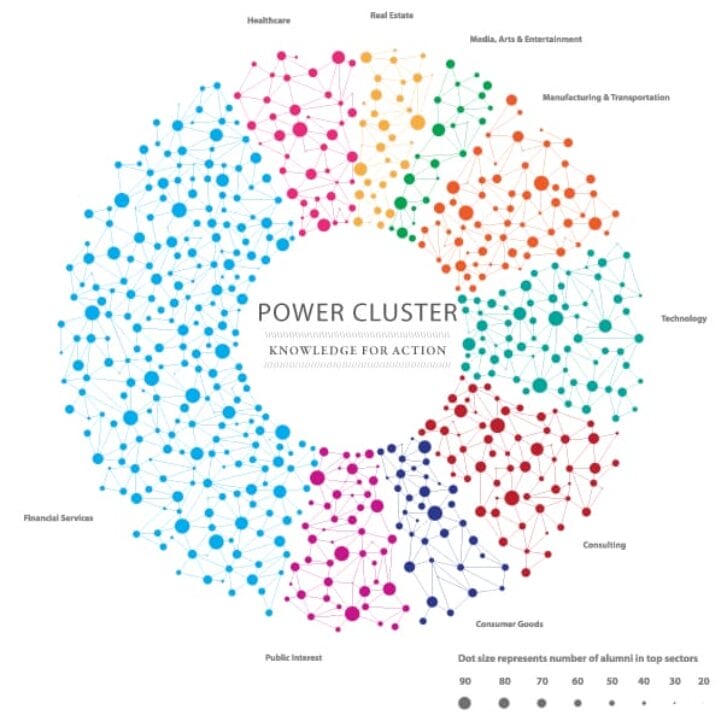

PETERSON: Wharton for me was a transformational experience from having been a mathematician and worked in econometric modeling in the oil industry. I was looking for Wharton to be a way to give me a different view of strategy, of international business, of finance and accounting, both broader strategic and management skills, and then also the technical and financial skills. So in a sense, I have continued to apply all of those viewpoints.I think about my ability to have become an effective banker right after I left Wharton and joined Citibank in 1985. The foundational skills I had from Wharton allowed me to become a banker really fast. As I progressed through my career and spent less time on individual transactions or individual clients and became more strategic, I was able to draw on other sorts of skills: marketing, strategy and planning, and other skills that I also picked up at Wharton.

WM: What were you like when you were a student on campus?

PETERSON: I was very curious. I’ve been curious my whole life, so I was involved in multiple activities. I was extremely international. I was part of the Asia Club, the Latin America Club, the Europe Club and the International Students Club. I was trying to go to [see] as many senior corporate and other leaders who were coming to campus. I was very curious and I was working hard, but I was also active with different groups to reach out, to try to learn more about the world.

WM: Can you talk about some of your pursuits and hobbies outside of work?

PETERSON: I had a period where my family was my hobby. That sounds a horrible way to say it, but spending time with my kids was absolutely important because they were growing up, and I preferred to go to soccer practice than almost anything else. They’re in college now. But other sorts of hobbies that were extremely fun, important, and I’ve kept them up through my entire life. Jazz music is one. I really like to travel a lot. And within travel, one of my favorite things is archaeology, and I’m a big fan of going to archaeology sites, temples, lost cities. This sort of thing is a very big interest of mine, and I have a list of places I have yet to go!

WM: What are your favorite locations?

PETERSON: My favorites so far are Machu Picchu in Peru, Angkor Wat in Cambodia and Kyoto. Kyoto is not really an archaeological site, but Kyoto is magical.

WM: Getting back to your love of jazz, do you play an instrument?

PETERSON: When I was young, I played lots of instruments, but I don’t play anything anymore. Just the iPod.