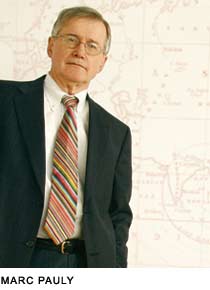

Wharton Health Care Systems Professor Marc Pauly delves into contrasting problems in health care insurance in the developed and developing worlds.

By Meghan Laska

Thousands of people lost their lives in the December 2004 tsunami. Billions of dollars were pledged in emergency relief. And although aid distribution efforts were hampered by the isolated terrain, officials said that it did slowly make its way to victims.

While the tsunami triggered an international crisis, health care systems professor Mark Pauly says that the main health care catastrophe in these developing countries wasn’t caused by a natural disaster, but triggered by more “mundane” things that don’t make the headlines. For example, the major killers of children, such as diarrhea and infectious diseases like malaria, in developing countries are more ever-present. “The irony—and I feel this myself emotionally—is that we now say we want to do something to help the tsunami victims, but people should have been doing that a long time ago,” Pauly says.

Pauly points out that more people in Indonesia died over the last 10 years as a result of poor health care and lack of insurance than died in the Banda Aceh tsunami. “The actual health consequences of the tsunami are so far relatively contained in that people either died or they didn’t,” Pauly says. He adds that he hopes that an end result of this disaster will be an increased focus on the quality and availability of health care for people in developing countries—something to which he has devoted much attention.

Searching for the Fatal Flaw

These days, Pauly’s focus on developing countries is through the lens of health insurance. He quips that his “esoteric theoretical” writings on insurance captured the attention of the World Bank, which then asked Pauly to take a look at the situation in developing countries to see if there are any fatal flaws to the emergence of insurance. After a trip to Ghana last summer and research on the issue, the short answer is “no.”

“The silver lining is that it seems like they could offer insurance,” Pauly says. “But at a practical level, you run into problems of trust. The idea of someone asking for money and in exchange giving you a piece of plastic which entitles you to health care seems crazy. They say, ‘Why should I believe you?’ How do you get people past that distrust?” And if the insurance program is run by the government, corruption is also a risk, as well as an inherent limitation of choices by the people. These are the challenges.

So when the World Bank invited Pauly on a mission to Ghana to assist in redesigning its overall health insurance system in the summer of 2004, he joined the team. What he saw in Ghana was worrisome.

Pauly explains that the majority of developing countries such as Ghana have a system of free medical care, but the financing is often woefully inadequate. “People may lack care because the Ghana health service can’t pay doctors enough to locate away from the big cities. People who need care end up paying out of pocket, using money they were going to spend on buying seeds for their crops or for fees to send their children to school.” He explains that Ghana realistically concluded that, since people were paying out of pocket for health care, they would call their system a “cash and carry system,” but then officials became concerned with the financial choices this forced people to make. The World Bank project asks whether instead of making big, occasional payments, perhaps people would pay smaller amounts periodically for insurance.

So after a firsthand look at the system in Ghana and researching what other countries have done, Pauly says there is reason to be optimistic. “I wouldn’t have recommended what Ghana ultimately chose to do [local government-run insurance program] to all countries, but it is admirable because at least it carries forward the principle of having insurance,” he says, adding that the government was planning to sign people up for the program last fall. “We can be optimistic because the alternative is worse and there is only room for improvement.”

Despite the many challenges, models of success exist in other developing countries, Pauly notes. An area in India, for instance, created a primitive health insurance system where people contributed money to a community plan that paid for some health care and medicines that otherwise would not have been available.

Singapore, meanwhile, has implemented a modern health insurance system. “It has become the poster child for a country that started with the British health system model, which was free but low quality, and they put in place a system of insurance and spending accounts to create quite a well-functioning health insurance system.” While Singapore is a small country that has emerged from poverty, it nonetheless serves as a hopeful example, Pauly says.

Recently, the World Bank has asked Pauly and colleague Peter Zweifel of the University of Zurich to write papers using high-level insurance theory to analyze whether there is a fatal flaw in efforts to provide real private and public health insurance in developing countries. “There may be a lot of practical problems and people have to make judgments about whether those can be overcome, but we determined that there are no logical reasons why we can’t have real health insurance. We have Singapore and other cases suggesting that it is not hopeless.” He explains that, while he doesn’t think the private insurance that emerges will be perfect, it will be much better than the alternative of a poorly funded, low-quality public system that causes people to prefer to pay out of pocket for effective care, with adverse consequences like “not sending your kids to school or not being able to plant a crop. But it’s a hard message to preach—that you can do the most good by doing a little even if it’s not perfect,” he says.

In March 2005, a Wharton Impact Conference called Voluntary Health Insurance in Developing Countries took a stab at preaching that message. Organized in collaboration with the World Bank, the University of California at Berkeley and the University of Zurich, the conference presented the preliminary work from a large international review of the potential role of private health insurance. In addition to professors such as Pauly, participants included policymakers from developing countries, leaders from the health insurance industry, and international development partners. Participants discussed topics such as the economics of voluntary health insurance at low income levels, the role of the health insurance industry and the World Bank Group, and ways to apply theory to practice.

Setting the Dials

Before Pauly, a two-time chair of the Health Care Systems Department, began working in the field in developing countries and researching health insurance there, his research was largely focused on U.S. health insurance issues—a subject that hooked him in 1967 when he was looking for a PhD thesis topic as a graduate student at the University of Virginia.

At that time, Medicare had been established, and government research money was plentiful. Pauly, who had strong interests in the role of the public sector and government in the private market economy, chose medical care seemingly by accident. “But once I got into it, I got stuck to it,” he recalls, adding that he thought at the time that having to learn something about insurance would be a real bother. “But it turns out that health insurance is endlessly fascinating and, when it comes to health care, insurance has a much greater impact on the health care market than, say, collision insurance has on auto-body repair or homeowners’ insurance has on the market for repairing homes.” Pauly notes that there are reasons for that and trying to understand those reasons and do something about them provides motivation for research. And over the years, the increased spending on health care also has provided motivation, as it has created a multitude of issues to study.

In addition to his interest in health insurance issues in developing countries, Pauly has also focused recent research on private health insurance in the U.S., in particular the issues surrounding administrative costs and moral hazard.

“Administrative costs don’t sound exciting, but they are,” he insists, explaining that these are the costs involved in processing claims and determining how much will be paid on each claim. Administrative costs, Pauly says, actually deserve the blame for why many people remain without health insurance today. “If you don’t have access to health insurance from a large employer, it will be a lot more expensive for you because you’ll have to pay more to cover those administrative costs and that extra amount is substantial,” he explains.

Pauly’s other research angle, called “moral hazard,” is the reality that when insurance pays for medical care, it can cause people who are insured to change their behavior in ways that actually increase the average amount of loss. “When people have health insurance, they will—just because they are human and not because of morality—take advantage of it,” he says, calling it “endlessly fascinating and frustrating to look at the ways people have tried to work against this kind of natural inclination.”

So what is the solution to administrative costs causing people to be uninsured and moral hazard driving up costs? Pauly admits to being a bit “wishy washy” in that he sees no single way to fix such problems. He says that the two main things that have been done—which are still being debated—are referred to as “demand and supply side.”

He explains that on the demand side, one way to prevent a person from overusing medical care is to require people to pay more out-of-pocket costs. “The current version of this is consumer-directed health care and medical savings accounts. We know that it works when people have to spend more money out-of-pocket because they will use less, but the adverse consequence is that you subject yourself to more financial risk and the whole point of insurance is to protect yourself from financial risk,” he says. “So the question is where to set the dial.”

Then there are “supply side” strategies such as managed care. “People pay almost nothing out of pocket, but the plan controls moral hazard by employing doctors and owning hospitals and offering incentives to those doctors and hospitals to be frugal and not do everything that patients want,” Pauly explains. He maintains that “the policy debate about consumer-directed health plans and controlling health care spending turns on trying to control moral hazard by either having people do it themselves by giving them more financial risk or having somebody in managed care or the government say how much you can supply of health care.”

What’s the solution? Pauly believes an effective system would incorporate features of a private health plan, with some supply-side aspects such as preferred provider arrangements and pretreatment approvals, with some demand-side aspects such as out-of-pocket payments by consumers. “We know much more about where not to set those dials than about where to put them,” he says. “My message is that trying to find a painless solution is foolish and doesn’t exist. What we really ought to do is find out what the tradeoffs are in between these different ways to control health care spending and then let people choose. We could have the government or a panel of experts decide, but I’d rather give consumers the power to choose among health plans and adopt a variety of different strategies.”

Pauly sometimes refers to this as the full-choice model: Consumers can choose a costly plan that lets them go to any hospital or doctor, or opt for an economical option—the HMO—with more restrictions on doctors. “It’s like buying a car—if you want the leather and side air bags then feel free to choose that, but if you have a lower income then there are things you can forgo to save money,” he says.

Medicare is another major component of Pauly’s research. Pauly recently finished serving on the Medicare Technical Review Panel which reported to the U.S. Secretary of Health and Human Services. The purpose of the panel was to give advice to the Medicare trustees about how to estimate future costs for Medicare. “Once you look at the costs it’s hard not to think that something needs to be done to save it in the future. Medicare may have to get a lot worse before politicians are motivated to make it get better. Ironically, the ‘good news’ is that it will get a lot worse pretty soon.”

He notes that it’s not just for the poor, as it is an insurance system that employees pay into over time like Social Security. But Pauly maintains that compared to Medicare, Social Security is in “wonderful shape. It’s not so much that Medicare will go broke, but that if you extrapolate the trends in Medicare spending, the taxes that will support older people could consume more than a third of wages,” he says.

One alternative Pauly has researched would require financially secure elderly to pay for more of their Medicare. “The future of Medicare is gloomy or we wouldn’t be talking about this,” he says.

Sifting Through Medical Waste

During a recent sabbatical in Ann Arbor, MI, Pauly shifted his research focus a bit to look at the quality of health care as opposed to health insurance, examining medical waste in terms of spending. “I looked at Medicare data from different cities that show there is enormous variation in what Medicare spends per elderly person even after you control for race, income and age. The places where they spend a lot, such as Miami, generally don’t get better outcomes than places where they spend a little, such as Bismarck—and that is evidence of waste in some places but not in others,” he explains, saying he suspects this has as much to do with social environment as it does with the health care system. He has gotten so far in this new area as to have titled a book he plans to write—Medical Waste.

When he returned from sabbatical in May, Pauly continued his other research areas, especially an extension of a pilot project in South Africa. Two years ago, Pauly and other researchers visited South Africa to collect data on the impact of poor health, especially AIDS, on micro and small businesses. A survey showed that these very small businesses such as market stalls are largely owned by women, and if the owner gets sick, then the business collapses. “We were trying to provide a case to the South African government and the world that improving people’s health would have economic benefits,” says Pauly, noting that this stratum of business owners in South Africa is of major importance to the country’s overall economic activity. He notes that they concluded that visit trying to propose some sort of health insurance arrangement for these small business owners. Now, Pauly would like to see the project continued.

So for someone who says he got into the study of health care by accident, Pauly has certainly made a long-term career out of it. “It’s dirty work, but someone has to do it,” he says, quoting health economist Victor Fuchs.

NAME: Mark Pauly

TITLE: Bendheim Professor; Professor of Health Care Systems, Business and Public Policy, Insurance and Risk Management, and Economics, Past Chairperson of the Health Care Systems Department

RESEARCH AREAS: Medical economics; health policy; health insurance

ACADEMIC POSITIONS: Wharton: 1983-present (Chairperson, Health Care Systems Department, 1997-2004; Vice Dean and Director, Doctoral Programs, 1995-99; named Bendheim Professor, 1990; Chairperson, Health Care Systems Department, 1990-94; Robert D. Eilers Professor of Health Care Management and Economics, 1984-89).

University of Pennsylvania: 1984-present (Professor of Economics, 1983-present; Executive Director, Leonard Davis Institute of Health Economics, 1984-89).

PREVIOUS APPOINTMENTS: Northwestern University; University of Virginia.

VISITING APPOINTMENTS: International Institute for Applied Systems Analysis, Laxenburg, Austria; International Institute of Management, Berlin, Germany

FAMILY: Wife (Kitty), three children